- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

Interest only vs principal & interest loans – which is better?

The RBA’s interest rate statement for December 2015

Property finance fundamentals…

*Updated: [date]

Smart property investors use $ millions of dollars of Other People’s Money [OPM] to build their investment portfolios!

And the best source of OPM… the Banks of course.

In fact, as a property investor your most important and valued investment partner is your Bank or Lender!

After all Banks want to lend you money; they don’t ask too many questions; and they don’t want a slice of your profits – they’re just a after a [small] guaranteed return on the money they lend you.

Borrowing money to invest is a must!

Without OPM it would be virtually impossible to build a property portfolio!

Don’t agree with us – try saving $400,000…

Even with 95% home loans, people today still find it difficult to buy property – often requiring the First Home Owners Grant [FHOG] and/or their parent’s equity [or pledge/guarantee] to get them over the line.

Serviceability & Equity Explained

Your ability to borrow money is determined by two main factors; Serviceability & Equity

Serviceability is your capacity to borrow money and pay it back with interest – it’s mostly dependent on your net income.

Equity is the amount of available cash [or equity] you have to put towards a purchase.

Serviceability Maximisation

You can improve your net income simply by increasing your income and decreasing your expenses.

Here’s a few ideas;

Increasing your income

- Apply for a higher paying job in your industry

- Ask your boss for a pay rise

- Work more hours or find some additional part time work.

- Buy a property in partnership with someone who has a high income

- Get the highest possible rental appraisal on the investment property you’re looking to purchase

- Increase the rents on your current investment properties

Decreasing your expenses

- Pay off and close any existing credit cards you have [switch to VISA or MasterCard debit card]

- Convert and current loans from principal & interest to interest only

- Refinance your current loans to a better rate & product

- Consolidate your high interest debts into a low interest home loan

- Sell your house and rent for less than your previous loan repayments

Equity Maximisation

You can improve your equity position by increasing your assets and decreasing your liabilities.

Here’s a few tips;

- Always borrow as much as you can in order to reduce the amount of equity you’ll need to complete the purchase

- If you’re self-employed prepare full financials and try and switch from a Low Doc loan [max 80% LVR] to a Full Doc loan [max 90-95% LVR]

- Save more money by setting up a proper working budget and an automatic savings plan

- Reduce your current debt levels by making extra payments on your loans

- Raise additional equity by getting finance on any other unencumbered assets you might own – ie. cars, boats, jet ski, plant and equipment etc.

- OPM – find and partner up with an angel investor who has the equity you require

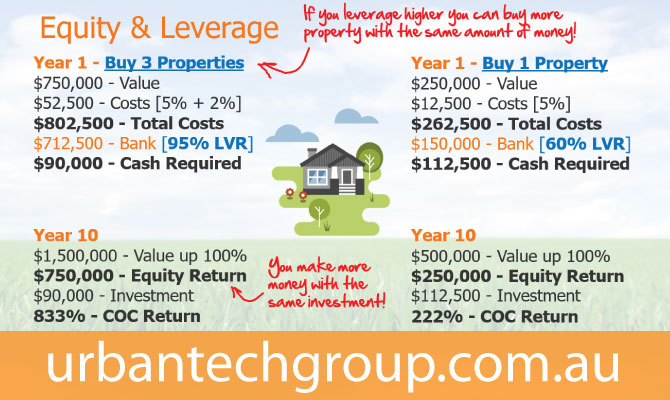

Leverage… Always borrow as much as you can!

The less money you contribute the better your return on investment [ROI] will be.

Plus you can do more deals with the same amount of money which means you’ll get growth on multiple properties.

What would you choose – a 60% loan with no LMI or a 95% loan with LMI costs?

Let’s take a look how the numbers stack up;

The more money you borrow the less cash/equity you require for the deal.

By leveraging higher you can buy more property with the same amount of equity.

Use a Finance Broker…

Mortgage/Finance brokers have access to an array of lenders and products including those from banks, non-banks, wholesale lenders, non-conforming lenders and even private funders and short term financiers.

As they intimately know the policy of many lenders they can help you find the loan that is just right for your financial situation.

Being loyal to your bank doesn’t pay – after all your bank won’t recommend you go to another bank or lender with a better rate. Worse, they often give new customers better deals than their ‘loyal’ existing customers!

Don’t be fooled, ‘Private Bankers’ & ‘Relationship Managers’ are still just bank sales people with quotas to reach each month!

In contrast, a good mortgage broker is a ‘finance strategist’, NOT a sales person for one set of bank products.

If you’re trying build a property portfolio you should always try and work with a broker who themselves are an experienced and active investor. [you’ll be hard pressed to find one at the bank!]

Good brokers also facilitate a ‘holistic’ approach to finance and wealth creation rather than just arrange a loan. When purchasing an investment property you should always consider the following;

- Financial planning advice

- Insurance advice

- Tax advice

- Legal advice

- Investment education/mentoring

- Property sales & management advice

Want to become a Real Investar!

We’ve created a property investment coaching program to help you eliminate your bad debts and build a passive income of at least $83,200 per year by buying only 4 average-priced investment properties.

>> For all details and to apply for our free coaching program click here

If you need any other details or just want to chat further, please call Sam on 0411 431 391

Cheers

Sam & Matt

Urbantech Group

Adelaide Mortgage Broker +plus more…