- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

Understanding Superannuation & SMSFs…

The RBA’s interest rate statement for October 2013

How to buy property using a self managed super fund

Self Managed Super Funds [SMSF] are now the largest and fastest growing segment in the Superannuation industry. The biggest reason people elect to manage their own superannuation is the flexibility to choose where their money is invested.

Self Managed Super Funds [SMSF] are now the largest and fastest growing segment in the Superannuation industry. The biggest reason people elect to manage their own superannuation is the flexibility to choose where their money is invested.

In 2007 superannuation law was amended to allow SMSFs to borrow money to purchase investment property. The SMSF lending industry has come a long way since this time and there’s now a large range of competitively priced loan options available to people who wish to invest their super money in property.

However take note: managing your own super is a big responsibility. Super is meant for your retirement, so there are special rules about how it is managed and when you can access it.

For more on this go here: https://www.moneysmart.gov.au/superannuation-and-retirement/self-managed-super-fund-smsf

SMSF property rules

You can only buy property through your SMSF if you comply with these rules;

- The property must meet the ‘sole purpose test’ of solely providing retirement benefits to fund members.

- The property must not be acquired from a related party of a member.

- The property must not be lived in by a fund member or any fund members’ related parties.

- The property must not be rented by a fund member or any fund members’ related parties. However, your SMSF could potentially purchase your business premises, allowing you to pay rent directly to your SMSF at the market rate.

SMSF property loans

- SMSFs can borrow money for the purchase or refinance of an investment property within the superannuation fund, with the property held in trust for the SMSF until the loan has been repaid.

- The loan is a limited recourse loan which means the lender’s rights of recovery against the SMSF Trustee is limited to the secured property if the loan goes into default.

- Serviceability of the loan can be demonstrated through rental income from the investment property as well as superannuation contributions.

- Some SMSF loans need to be supported by personal guarantee/s from the beneficiaries of the SMSF.

- The trust may be entitled to potential tax deductions by offsetting the loan’s interest and other borrowing/property expenses against the property’s rental income. The borrower/guarantors should seek financial and legal advice.

Who can obtain a SMSF loan?

- Australian residents that have an existing SMSF or are in the process of establishing an SMSF.

- SMSFs with an existing residential investment property loan that want to refinance from another lender.

SMSF Loan Product Specs

| AVAILABLE FEATURES | |

| Principal & Interest | Yes |

| Interest Only | Yes |

| Option to Fix | 1-5 Years |

| Additional Payments | Yes [only by SMSF] |

| Redraw | No |

| Offset Account | Yes |

| FEES | |

| Can include; application fees, legal fees, valuation fees, monthly fees | Yes |

| LENDING GUIDELINES | |

| Security | 1st Mortgage Only |

| Loan Purpose | Investment Only |

| Min Loan Amount | $100,000 |

| Mortgage Insurance | No |

| Maximum LVR | 80% [Residential] |

The SMSF Loan Process

- Borrower sets up an SMSF.

- The trustee of the SMSF selects an investment property to purchase.

- The trustee of your SMSF appoints a Custodian [Property Trustee] to purchase the investment property on its behalf.

- The trustee of the SMSF applies for a loan with a SMSF lender.

- The SMSF pays the deposit and exchanges contracts on the purchase. The Property Trustee will purchase the property and become the legal owner [i.e. it is the purchaser shown on the contract for sale]. The SMSF will obtain the beneficial interest in the property.

- The loan is advanced to the SMSF.

- The lender takes a mortgage over the legal interest in the property from the Property Trustee and a charge over the beneficial interest in the property from the trustee of the SMSF. There is no recourse against the assets of the SMSF other than the security property.

- A guarantee may be obtained from beneficiaries of the SMSF. Collateral security cannot be taken from the SMSF itself.

- Loan funds must only be used for the purchase or refinance of a property and there can be no redraws or further advances.

SMSF Case Study

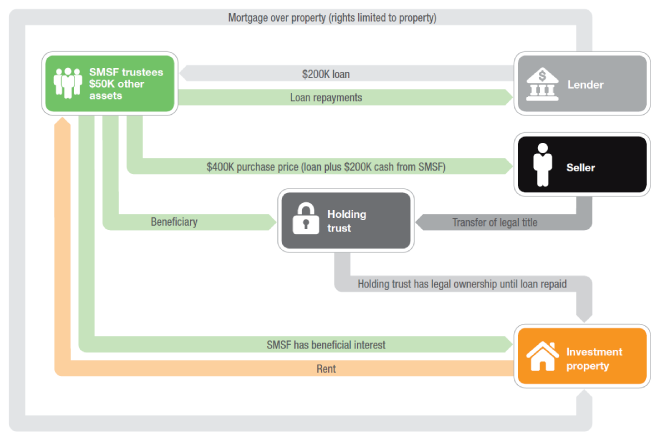

William and Jane Barker have an SMSF with $200,000 in cash and $50,000 in other assets. They would like to buy an investment property within their SMSF. The property, however, is worth $400,000 which means the SMSF doesn’t have enough money to cover the full cost of the purchase. In this instance, the SMSF trustees can apply for a SMSF Property Loan.

William and Jane Barker have an SMSF with $200,000 in cash and $50,000 in other assets. They would like to buy an investment property within their SMSF. The property, however, is worth $400,000 which means the SMSF doesn’t have enough money to cover the full cost of the purchase. In this instance, the SMSF trustees can apply for a SMSF Property Loan.

How does it work?

The Barkers seek independent financial and legal advice to ensure it is appropriate for their SMSF to borrow money and purchase an investment property. Once they have received this advice they begin establishing the trust structures required for the loan, ensuring they comply with the relevant superannuation laws.

The loan would then need to be taken out by the SMSF trustee. The Barkers will also need to set up a separate holding trust, which will be the legal owner of the property.

To purchase the property, the SMSF can use the $200,000 it has available in cash and borrow the remaining funds plus other associated costs, using the investment property as security for the loan.

The holding trust becomes the legal owner of the property, while the SMSF is the beneficial owner and receives the rental income.

The rent [and/or other income from the SMSF, such as investment income and super contributions] can be used by the SMSF trustee to make the loan repayments.

Image Source: Maquarie Bank

Note: It’s important to note that the loan is a limited recourse loan. In the event of a default, the lender has recourse to the property security and any additional security provided by the guarantors. However, the Lender will not have recourse to any other assets held in the Barkers’ SMSF. Once the loan is repaid the legal ownership of the property can be transferred to the Barkers’ SMSF.

We recommend clients obtain independent financial, legal and taxation advice before making any financial investment decision.

For more info or help arranging a SMSF loan please don’t hesitate to contact us anytime.

Sam & Matt

Urbantech Group

>> Free Finance & Wealth Evaluation +plus more…