- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

The RBA’s interest rate statement for July 2016

How to get a better deal on your home loan rate…

Capital Growth + Positive Cash Flow + Instant Equity?

Investing is a numbers game, the aim being to achieve the highest possible return on your money, while effectively managing any risks.

Property investing is no different. If we forget for a moment about the obvious tangibility of property, it’s really just a bunch of numbers on a page.

To win in the game of buy & hold property investing you need only two things – capital growth and cash flow.

Thanks to the availability of cheap money and the accessibility of reputable research and rich data, it’s never been easier to stack the odds in your favour.

No one can consistently predict future price movements of property, however with the correct approach we can increase the likelihood of achieving better-than-average results.

BIS Shrapnel just released their 3 year property price predictions for all major property markets around Australia – you can read a nice summary of the results here

What’s clear is that you can no longer limit yourself to just one geographic location when investing in property.

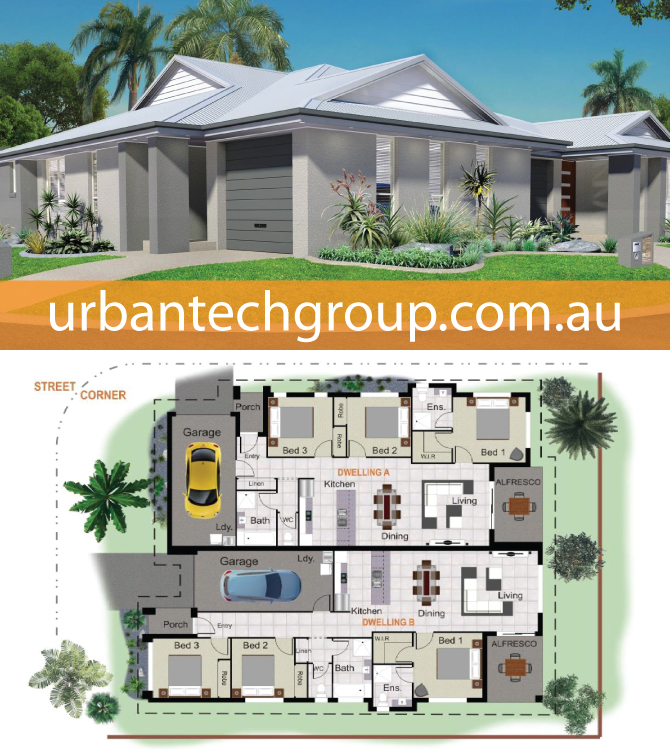

Below is a dual income property we’ve sourced in Ormeau, an up-and-coming suburb in the northern growth corridor of the Gold Coast. This property provides positive cash flow, capital growth and a potential instant equity gain – some would call this a property investment trifecta!

3+3 DUPLEX PROPERTY: **SOLD**

Lot 586 Custodian Cres, Ormeau, Gold Coast QLD

Property Analysis

A fixed price, turn-key, dual income property located in the suburb of Ormeau in the Gold Coast.

This cash flow positive 3+3 Duplex [6br/4b/2c] comes on one title, and can be subdivided after settlement into two separately titled properties giving you an instant equity uplift.

Here’s how the numbers look;

| Purchase Details | |

| House Price: | $412,096 [267 sqm] |

| Land Price: | $355,000 [879 sqm] |

| TOTAL PRICE: | $767,096 [includes titling fees] |

| Rental Details | |

| Rent: | $820-880 pw [5.56 – 5.97% yield] |

| CASH FLOW: | +$275 pw* [$14,300 pa] |

| Re-Titling Details | |

| Titling Fees: | Included in purchase price |

| Property 1 Value: | $435,000 – $450,000 |

| Property 2 Value: | $435,000 – $450,000 |

| TOTAL NEW VALUE: | $870,000 – $900,000 |

| EQUITY UPLIFT: | $102,904 – $132,904 |

| Investment Return | |

| 10 Yr IRR | 48.51% [pre-tax return on all money invested over 10 yrs] |

| 1 Yr RETURN | $102,904 – $132,904 [equity uplift] + $14,300 [rent] + $57,532 [capital growth] |

*based on borrowing 90% of purchase costs at a rate of 4.25% with tax credits calculated using an annual income of $80,000.

SUMMARY:

This property is cash flow positive $275/week in the first year [$14,300 pa], plus you potentially get a huge $103-133K equity uplift after re-titling.

All up, including capital growth, you have the potential of making ~ $175K – $205K after just one year.

To purchase this property, you will need approximately $115-190K in available equity or cash [depending on your loan size]

Area Analysis

Ormeau

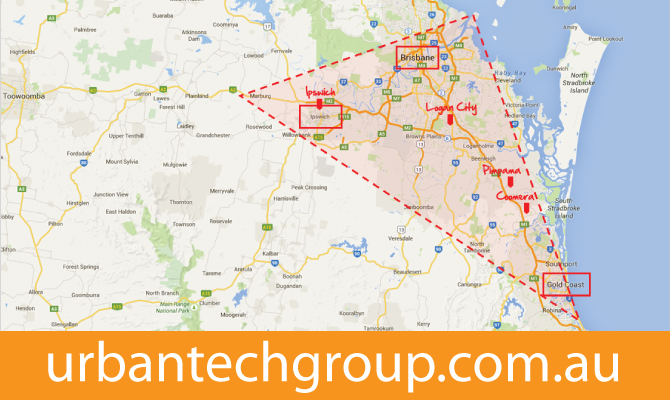

Ormeau is a suburb [adjacent to Pimpama] in the city of Gold Coast in South-East Queensland [SEQ].

The Gold Coast is known for its extensive golden sandy beaches, perfect surfing spots and the ever popular theme parks including Dream World, Movie World and Sea World. Along with an incredible lifestyle the Gold Coast has low median prices, falling vacancy rates, high population growth and strong employment. In fact, the Gold Coast is also one of Australia’s fastest growing regions, with population growth of 2.3% pa forecast, compared to just 1.6% across Australia.

In recent times there has been a notable shift within the residential market towards the northern corridor of the Gold Coast with its proximity to Logan and Brisbane. Low supply and increasing demand coupled with the recent announcements of several large infrastructure and development projects ahead of the 2018 Commonwealth Games has helped to elevate Ormeau into one of the major growth areas of the Gold Coast LGA.

South-East Queensland

Property powerhouse John McGrath says there’s only one place in all of Australasia to be buying real estate right now – and that’s in South-East Queensland. To read why he and many other experts are so keen on SEQ click here

TAKING THE NEXT STEP…

We’ll provide you with all of the details you need to make an informed investment decision. This includes a detailed Property Investment Analysis [PIA] report, property brochure, site plan, inclusions list, a rental and sales appraisal from local real estate agents, area research reports and any other relevant supporting information.

To secure this property you will need to complete a simple Expression of Interest [EOI] form and pay a refundable holding deposit [usually $1,000]. Your offer is also subject to finance and is not binding should you not be able to get finance approval.

>> If you would like to enquire about this property please call Sam on 0411 431 391

IMPORTANT:

Unlike other property groups out there we don’t develop and on-sell our own property, instead we go to great lengths to ensure the properties and areas we recommend have the greatest chance of out-performing the broader market. That’s why we avoid apartments, projects where there are too many investors, and areas that are reliant upon one industry, such as mining towns. We’ve built up a strong network of developers and builders around Australia and have worked hard to source these properties.

We only work with reputable builders who get the job done, so build times are usually 180 days or less. The properties are also 100% turn-key and ready for tenants to immediately occupy – standard inclusions are; air-conditioning, blinds, security screens, full landscaping, fences, antennas and letterbox. All council fees and charges [soil test and engineering] are covered by the builder and you get a 12-month maintenance period [for any defects] and a 20-year structural guarantee. There’s no hidden costs, surprises or extras for you to organise. We can also help you find an excellent local property manager and arrange to have a full depreciation schedule completed at the end of the build.

Since the Sydney and Melbourne property markets have peaked, SEQ has been getting more attention in the media – so the word is getting out… What this means is overall there is less stock available and the uptake is pretty fast – many properties sell within 1-2 weeks of being released. So if you are interested in any of the deals we send through please contact us immediately so we can put a temporary hold on them for you.

The above information and service is provided by Urbantech Property Pty Ltd [ABN: 65 127 477 490] trading as Real Investar. Real Investar is the provider of generalised property investment education and advice, not financial advice or credit advice.

Cheers,

Sam

Real Investar | Urbantech Group

PS. Why are we promoting property in SEQ?? – we explain here. Want to know why we are recommending brand new ‘turn-key’ dual income house & land packages? – read our article here

PPS. We recently profiled a duplex property in the Ipswich suburb of Brassall – you can view it here