- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

The RBA’s interest rate statement for November 2015

Smart financing tips for property investors

Should you convert interest only loans to principal & interest?

For as long as I can remember ‘interest only’ loans have been priced the same as ‘principal & interest’ [P&I] loans, however that all changed not too long ago, when lenders began putting up interest only loan rates.

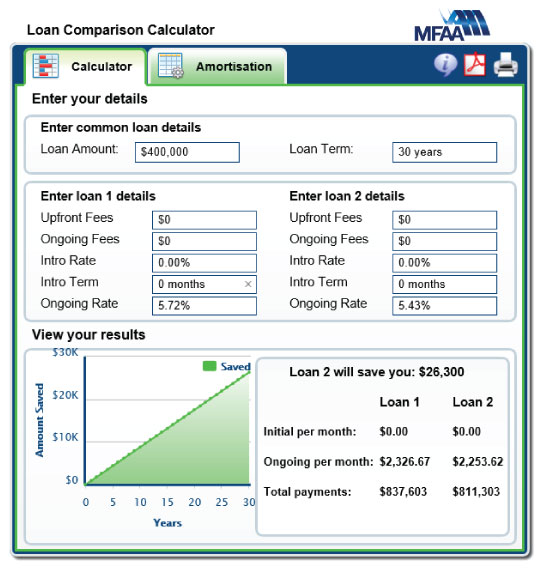

As an example, if the standard variable interest rate on a NAB interest only loan is 5.72% the equivalent principal & interest home loan rate will be 5.43%.

That’s a difference of 0.29%!

Which begs the question – is it worth paying a premium to have an interest only loan?

If you have an interest only home loan and you’re already making extra payments each month [either directly into your loan, line of credit or offset account] then you are in fact already paying principal and interest – so in this case you could be better off switching to a less expensive P&I home loan.

Using the NAB example above you could expect to save $26,300 over the life of your loan by switching to the P&I rate.

But there’s more…

The difference between monthly repayments on the 5.72% loan [$2,326.67] and 5.43% loan [$2,253.62] is $73.05 per month.

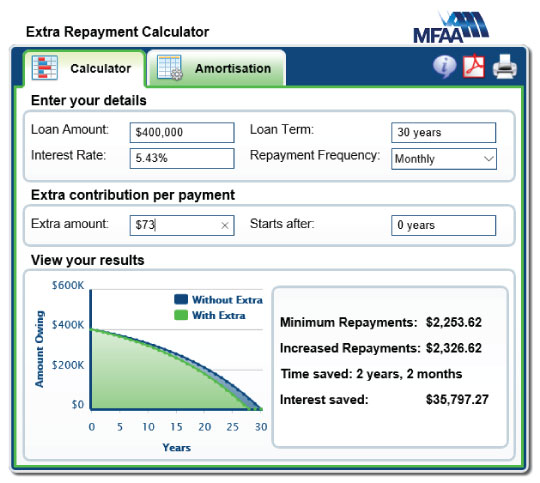

While it doesn’t sound like much here’s what it looks like if you took the $73.05 saving and paid it into your loan each month in addition to your usual minimum repayment.

The result: an additional saving of $35,797 in interest and a reduction in your loan term of 2 years and 2 months.

Why are interest only loans so popular?

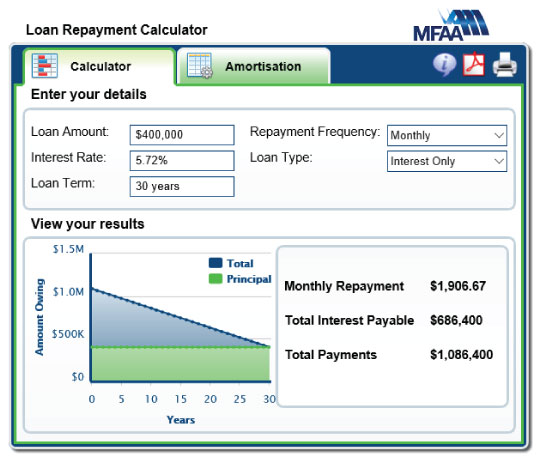

The main reason is they’re cheaper… that is compared to an equivalent principal & interest loan the repayments are cheaper each month, as you are only paying off interest.

Using the same example, even at the slightly higher rate of 5.72% the monthly repayments on an interest only loan are only $1,906.67 compared with $2,253.62 for the cheaper 5.43% P&I loan – that’s a difference of $346.95 per month.

From a lending perspective lower repayments improve your serviceability, allowing you to borrow more from lenders. So if you’re borrowing capacity is limited an interest only loan might help you borrow that extra bit of money you might need to buy the property of your dreams.

Another reason interest only loans are popular with home owners is they allow you to lock in the lower monthly repayment while still giving you the ability to pay off as much loan principal as you like, whenever you like.

This provides a level of flexibility for the person with variable income and/or expenses. For example, if cash flow is reduced for a few months you can just pay the minimum interest payment on your loan and when things pick up you can start making larger repayments again.

Interest only loans are also ideal for property investors who want to use their residual savings and income to pay down their non-deductible home loan debt. Because from a tax perspective it doesn’t make sense to pay off deductible investment loan debt when you still have non-deductible debt, such as your home loan.

In this case it makes sense for your investment loans to be interest only so that any remaining income can be used to pay down your cheaper and non-deductible principal & interest home loan.

>> For expert guidance on whether you should consider converting your interest only loans to P&I call 8451 1500 or email us.

PS. Free Loan Calculators – if you want to have a play around with the numbers yourself, we’ve recently uploaded a whole suite of loan calculators to our website.

Sam & Matt

Urbantech Group

Adelaide Mortgage Broker +plus more…