- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

The RBA’s interest rate statement for February 2019

Prime minister backs mortgage brokers…

Home loans are set to become more expensive…

The sustainability and viability of the entire mortgage broking industry is at risk thanks to recommendations handed down by Commissioner Hayne as part of the Banking Royal Commission’s final report, released just a few days ago.

Put simply the Royal Commission has advised major changes to the revenue model of our industry recommending borrowers [You], rather than lenders such as banks, pay brokers for their service.

These changes if implemented, will all but destroy our industry, damage competition in the home lending market and drive customers back into the branches of the big banks.

Not only will it reduce access to credit for home buyers who rely on some 17,000+ mortgage brokers to advise and assist them, but it will undoubtedly result in higher interest rates and fees as banks move to boost profit margins in a post-broker world.

Plain and simple, the recommendations to abolish all mortgage broker remuneration represents a HUGE win for the big 4 banks!

As you can imagine we as an industry are deeply concerned, frustrated and angry.

As mortgage/finance brokers we always put our customers’ interests first, and it is simply not right that we have been targeted by a Royal Commission that was meant to clean up the bad behaviour of the banks!

In fact, what was supposed to be a day of reckoning for the big banks and corporate greed, has turned into a share price boon for them!

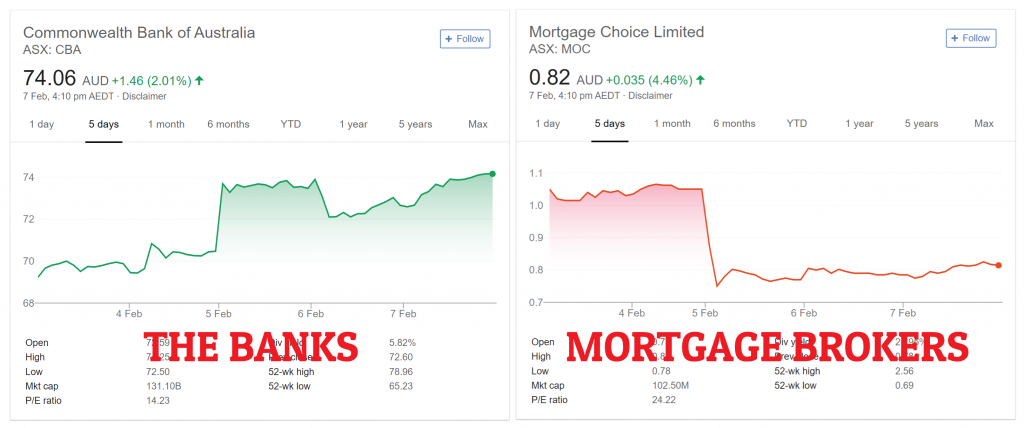

Here’s the share price of CBA following the release of the Royal Commission’s final report on Feb 4. Compare it to the share price movement of publicly listed mortgage broking business Mortgage Choice. It’s clear to see who has come out on top.

What the RBA governor had to say about mortgage brokers…

Despite expressing support for Commissioner Hayne’s recommendations relating to the provision of credit, Mr Lowe questioned the commission’s call for a borrower-pays model in the third-party channel.

Instead, the RBA governor expressed support for the government’s plan to phase out trailing commissions by 2020 while retaining upfront commission payments to brokers.

“In principle, I agree with trailing commissions being banned and the payments being up front,” Mr Lowe said. “I think the government is right to be cautious about going the full way and making the borrower pay.

“The Productivity Commission has written extensively about this. There are legitimate competition issues and I think it is worth taking the time to work through those.”

>> Sign our petition in support of mortgage broking

The mortgage broking industry was never broken!

For the past 10 years mortgage brokers have had to comply with responsible lending requirements under the NCCP Act. Created to regulate credit providers and protect consumers, and with firm oversight and governance by ASIC, the NCCP Act has helped to eliminate part-time brokers, raise minimum education requirements, improve transparency and ensure the delivery of quality credit advice to consumers.

Since this time our industry has undergone further probes, reviews and evaluations, all of which have failed to uncover any systemic problems or issues.

Not only are customers not disadvantaged by using a mortgage broker, on average they get a better deal through a broker – it’s why mortgage brokers now originate almost 60 percent of all Australian home loans.

For an industry that started from scratch 30 years ago it’s clear vindication of the immense value mortgage brokers provide.

In fact, the competition that brokers have brought to the market has contributed to a fall in net interest margins of more than three percentage points* – this equates to an interest saving of more than $300,000 on a $500,000 thirty-year home loan.

It’s no wonder the likes of CBA and Westpac are backing the Royal Commission’s recommendations to destroy the mortgage broking industry.

>> Sign our petition in support of mortgage broking

HOW YOU CAN HELP SAVE MORTGAGE BROKERS

Our industry is working very hard to ensure that mainstream media, consumers and policy makers understand the full ramifications of the recommended changes.

We need your help to make sure policy makers understand the critical role mortgage brokers play in driving competition, choice and access to credit, and what a world would look like without them.

Some of the ways you can help;

>> Visit the MFAA Your Broker Behind You website and sign our petition – https://www.brokerbehindyou.com.au/support-your-broker/

While you’re there you can also use the simple emailing tool provided to contact your local Federal MP in support of mortgage broking.

>> Visit the Change.org ‘Save the Mortgage Broking Industry’ page and sign the petition – https://www.change.org/p/federal-treasurer-josh-frydenberg-save-the-mortgage-broking-industry

>> Share our Facebook Post [or any others supporting mortgage brokers you find] and help spread the word – https://www.facebook.com/urbantechgroup/posts/10157041778686228

Rest assured as an industry we will continue to fight on behalf of Australian home buyers over the coming weeks and months.

IN THE MEDIA

RBA weighs in on RC recommendations

Industry Urges Australians To Protect Competition in Home Lending

Sky News interview with MFAA’s Mike Felton

On mortgage brokers: the Royal Commission has this wrong

‘Interest rates are going to go up’: Mortgage broker fury at commission crackdown

Westpac’s Hartzer tips demise of mortgage broker commissions

86% of investors want broker help

National campaign launches to support brokers

Royal omission: Banking misconduct report ‘has failed victims’

Thank you for your support!

Cheers

Sam, Matt & Andy

Urbantech Finance

Adelaide Finance Brokers + a lot more…

PS. There is a lot of water to go under the bridge before [and if] these recommendations become policy or even legislation. Until such a time it is business as usual! As your trusted mortgage broker you can continue to rely on us to get you the best deal on your loans.