- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

The RBA’s interest rate statement for April 2016

How to buy dual income property in high growth areas…

Building your investment plan…

*Updated: [date]

In our eBook we aim to demystify property investing and show you how to build a large passive income using simple tried-and-tested strategies.

In fact, we lay out the exact plan for generating an ongoing income of $83,200 pa. by buying just 4 average-priced investment properties.

And because this income is derived from rent it keeps growing year in, year out… eventually doubling to $166,400 pa. and then beyond.

Our core property investment strategy is also completely ‘passive’ – unlike the case with property development and renovation. This means you get to focus your time and energy on your job/business and your family & friends, rather than getting weighed down by the demands of managing a big renovation or development project.

But the key to all of this is to actually take action and properly execute on your investment plan…

Unfortunately many investors come unstuck when they unnecessarily over-complicate things; stray from their original investment plan; or worst of all, buy the wrong property in the wrong area and therefore fail to achieve the level of capital growth needed to build real wealth.

Remember, a property averaging 4% annual capital growth will take 18 years to double in value, whereas a property growing at 8% will double in value in just 9 years – that’s a significant difference!

Note: To learn how to build an investment plan download a copy of our eBook, or alternatively check out our 7-part property investing email series.

Finding the best locations to buy in…

Anyone can buy an investment property but if you want to create wealth and an ongoing income you need to buy high-yielding property in areas with excellent long term capital growth prospects.

For strong cash flow you need to buy the right ‘type’ of property and for capital growth nothing is more important than the ‘location’ you choose to buy in.

We recently wrote an overview of how you can ‘beat the market’ when investing in property, however in this article we’re going to get into the specifics of where you should invest, and why.

As you know the various property markets around Australia differ greatly at any one time so it’s crucial to research which areas are on the way up, and to avoid those that have already peaked, or are on the decline.

This often means you need to look outside of your own suburb and state if you’re serious about finding the very best performing and up-and-coming areas.

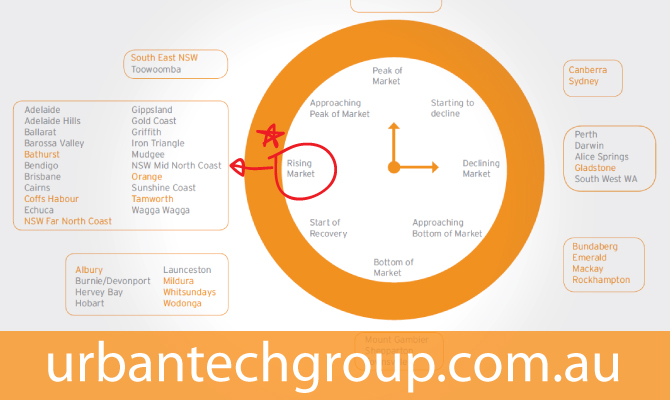

For a snapshot of the current market here’s the latest ‘property clock’ from valuation and advisory group Herron Todd White;

To view a larger full version click here

As a buy & hold investor you need to be considering buying property in the locations listed in the ‘Rising Market’ segment of the property clock.

The challenge, is then to identify the ‘best of the best’ areas to invest in based on 3 core factors;

- Affordability – it goes without saying; if you can’t afford to buy a property in an area, you can’t invest in it! The good news is areas with an affordable median-price tend to grow faster overall;

- Rental Return/Yield – if the yield is too low your holding costs become prohibitive and can limit you from buying more property. You should look for a yield of at least 5% – preferably higher, so the property can be positively geared;

- Long-term Capital Growth – to build wealth you need capital growth. If you buy in an area with low capital growth it will take you many years longer to achieve your goals. Areas that experience solid year in, year out, capital growth are best. You can find these areas by analysing supply & demand trends as well as by researching fundamental growth drivers.

So what do we think is currently the best location to invest in as a buy & hold investor?

The answer is…

South-East Queensland!

It’s great to see Adelaide in the rising market segment of the property clock, and there’s certainly some solid investment options here for local SA investors, however based on our market research there’s little doubt that South-East Queensland [SEQ] is the location best positioned to be the standout performer [for both cash flow & capital growth] over the coming years…

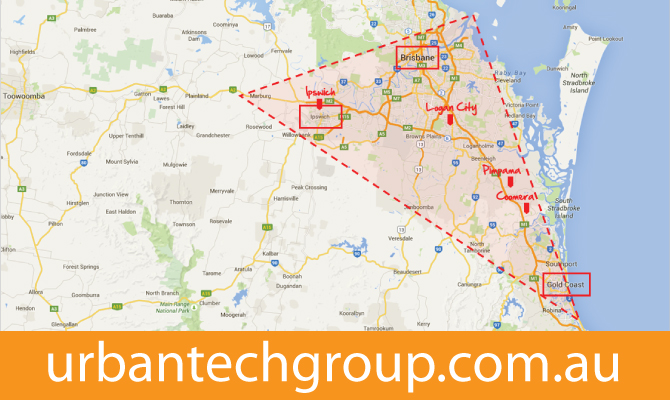

More specifically, the ‘growth corridor’ between the Gold Coast and Brisbane which includes locations such as Ipswich, Logan City, Pimpama and Coomera.

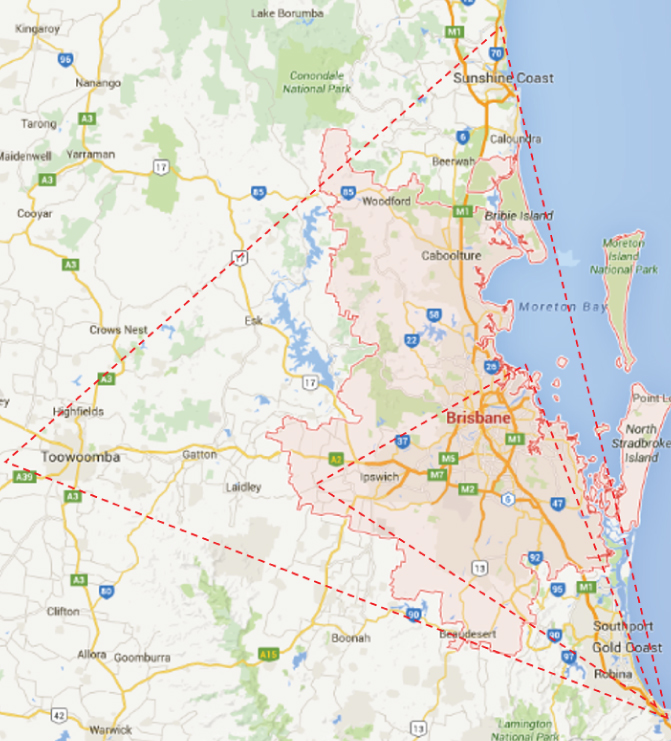

These areas also form part of a larger SEQ region often referred to as the ‘Golden Triangle’.

You can see the locations on the maps below;

SEQ Growth Corridors – West [Brisbane to Ipswich], South [Brisbane to Gold Coast], North [Brisbane to Caboolture]

The Golden Triangle – Sunshine Coast to Toowoomba to Gold Coast

Some of the key fundamental drivers for the SEQ region are population growth, strong employment, proximity to amenities, a plethora of infrastructure projects, and a limited supply of land. [It’s estimated there’s only 9 years’ worth of residential land left to develop between Brisbane and the Gold Coast.]

South-East Queensland is currently in the middle of an infrastructure revolution with more than $15 billion committed thus far on; underground tunnel networks, upgrades to motorways, a second gateway bridge, upgraded and extended rail links, utilities, public hospitals, universities, business and commercial parks, international sporting facilities and long term tourism infrastructure projects.

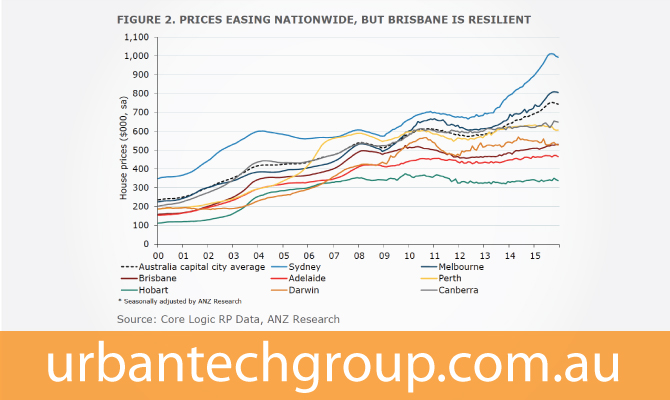

If you look at the chart below, aside from the recent Sydney and Melbourne property booms [which have now ended] all other capital cities have been flat – the only exception being Brisbane which has been steadily rising. [Remember, these figures are only reflective of the ‘overall’ Brisbane market, so some areas are starting to rise much more rapidly.]

Brisbane is outperforming all other capital cities and is expected to become the best performing market in Australia over the next 3 years and beyond.

But don’t take my word for it…

Here’s what a number of property experts and industry insiders have to say about South-East Queensland;

John McGrath – CEO, McGrath Estate Agents

John McGrath identifies the property golden triangle to buy now for capital growth

Property powerhouse John McGrath says there’s only one place in all of Australasia to be buying real estate right now. And that’s in south east Queensland. The founder and CEO of McGrath Estate Agents – who has 64 offices all over Australia – also thinks Sydney’s housing boom has almost run its course.

Right now, you can lock in the cheapest money you have ever been able to borrow. I am telling my clients to buy on the Gold Coast or in Brisbane. South East Queensland is my top pick of everywhere to buy in Australasia at the moment.

You can live a multi-millionaire’s lifestyle on the Gold Coast without being a multi-millionaire. You can walk, go for a swim at the beach and go to any number of restaurants. For us I see the golden triangle out to Toowoomba, up to the Sunshine Coast and down to the Gold Coast.

Anywhere in Queensland will do well but I’d be hard pushed to find anywhere better to invest than the South East of Queensland in the next 3-5 years for capital growth.

Sydney property is 40% overvalued. Brisbane and SE QLD are undervalued

While McGrath sees a period of consolidation in Sydney and Melbourne’s housing markets, he said that there likely brighter times ahead for Australia’s smaller capitals, especially when it comes to Brisbane and southeast Queensland.

“If you look at the traditional gap in value between Sydney and Brisbane, it’s certainly greater now than I’ve ever seen in the 35 years of real estate history,” he said.

“So, do I think Sydney is overvalued? Yes. Do I think Brisbane is undervalued? Yes. I think Brisbane and SE QLD are undervalued.”

Source: https://www.businessinsider.com.au/sydney-house-prices-overvalued-john-mcgrath-2017-8

The BIS Shrapnel Residential Property Prospects 2015 to 2018

Brisbane house prices to buck national easing trend: BIS Shrapnel 2018

Brisbane is the only capital city tipped to buck the national trend of easing median house prices in real terms over the next three years, according to housing forecasters, BIS Shrapnel.

A total rise of 13 per cent in the Brisbane median house price is forecast over the three years to 2018. …Significantly, Brisbane is tipped to be the only capital city that will not experience a decline in median house prices in real terms in the next three years.

CoreLogic RP Data released on Wednesday found Brisbane had the highest investment yields of the major metropolitan markets for both houses and apartments.

Macquarie Wealth Management Unit

The $8b exodus: Sydney home owners are selling up and Queensland is the big winner

Sydneysiders are cashing out of their million-dollar homes in favour of cheaper houses in the tropical north, says Macquarie Bank.

The emerging exodus is part of Australia’s latest wave of interstate migration to Queensland, where house prices are half Sydney’s and job creation is on the rise. When similar factors were at play in the mid-1980s and mid-2000s, an average 134,000 people made the trek north over a three-year period. They were mainly from New South Wales, Macquarie said.

Terry Rider – CEO, Hotspotting.com.au

Hottest Brisbane market is in the middle-ring

There’s been quite a chorus of commentators suggesting that, with Sydney having almost exhausted its three-year ride at the top, that Brisbane and South East Queensland is the next market to demand the focus of buyers. At Hotspotting we tend to agree with that!

Brisbane’s recovery, in terms or rising sales volumes, began in the middle-ring suburbs north of the CBD – the precinct I call Brisbane Northside – about 18 months ago. This has translated into double-digit growth in median prices in many of the Brisbane Northside suburbs.

More recently, the focus has switched to the south. A year or so ago, Logan City (the LGA which covers the urban landscape between Brisbane City and Gold Coast City) began to rise. The Price Predictor Index nominated Logan City as the No.1 municipality in Australia in terms of the number of suburbs with rising sales volumes.

5 key suburbs across Australia to watch in 2016

The Gold Coast is now the clear national leader among the Local Government Areas of Australia. It has the most growth suburbs, by a wide margin.

These rising suburbs are found right across Gold Coast city, but the growth corridor stretching north from the Gold Coast towards Brisbane is the standout area, with growth suburbs either side of the Pacific Motorway.

…Growth suburbs in this precinct include Coomera, Upper Coomera, Pimpama and Ormeau. Logan City, which borders the Gold Coast to the south and Brisbane City to the north, has led the revival of Greater Brisbane markets in 2015.

It has more growth suburbs than any other precinct in the Brisbane metropolitan area, headed by Beenleigh, the administration centre for the LGA, where house sales have increased steadily over the past 12 months or so.

Gold Coast property market a tale of two cities

There is more momentum in the Gold Coast suburban market – what I call the genuine residential market of the Gold Coast – than anywhere else in Australia right now. …The housing market, is responding to population growth, infrastructure spending and other stimulus to produce rising sales activity and price growth across the region.

As Sydney’s boom ends, other locations step up

Right now, mainstream media is running simplistic and misleading story lines such as: the boom is over, the bubble is about to burst, no one can afford to buy, etc. The reality is that, while Sydney’s boom is winding down, there are many locations around the nation which will have growth markets in 2016 and beyond. It’s no accident that some locations out-perform on capital growth. Areas become hotspots with superior growth for clearly defined reasons.

In simple terms, the best buying in 2016 for future growth will be found in Brisbane, Adelaide, Hobart, parts of Melbourne and selected regional centres, including the Gold Coast, the Sunshine Coast, Cairns, Port Macquarie, Newcastle and environs, Albury-Wodonga, Geelong and Bendigo.

SEQ overtaking Melbourne in price growth prospects

Melbourne is the No.1 capital city, still buoyant in contrast to Sydney’s steady decline. But South-East Queensland – the vast urban area including the Gold Coast, Brisbane and the Sunshine Coast – now has more growth suburbs than the Melbourne metropolitan area.

Logan City, which borders the Gold Coast to the south and Brisbane City to the north, led the revival of Brisbane markets in 2015 and continues to be the standout precinct (just ahead of Moreton Bay). It has more growth suburbs than any other Brisbane precinct.

Simon Pressley – Propertyology

Queensland’s unprecedented infrastructure pipeline

An unprecedented level of major projects in the pipeline has the potential to produce significant growth in Queensland property markets. According to our research, there are thirty seven major infrastructure projects with a combined project value of a staggering $123 billion. If they were all to proceed they would create 142,900 new direct jobs.

What has been unfolding behind the scenes in Queensland is quite exciting although few people realise it. I doubt whether any state at any time in Australia’s history has ever had such a big pipeline of projects.

We flag Brisbane, Gold Coast, Toowoomba, and Cairns as property markets with very promising outlooks.

Urban Development Institute of Australia – UDIA QLD

2016 marks the return of Queensland’s owner occupier market: UDIA

The third Industry Insights Report talks about the trends in land, house and apartment sales, supply and prices across Queensland. It reveals a marked shift in the residential property market in 2015, with the focus shifting from regional Queensland to the South East.

South East Queensland hotspots include Brisbane, Gold Coast, Ipswich, Logan and Moreton Bay, all showing price growth in land and house sales volume.

Antonia Mercorella – CEO, REIQLD

Bouyant Gold Coast seeing more investors

Compared with the southern states, Queensland’s market has been relatively stable and has resisted the volatility shown in those markets.

Brisbane surrounds also showed improving buyer demand, with Ipswich and Logan recording double digit growth in sales activity over the quarter and over the year to June.

The southeast corner remains the powerhouse of the state’s real estate market, with Brisbane LGA recording a new high median house price of $610,000.

Property market improving in Brisbane

NOW is a really good time to live in Brisbane. It’s an even better time to own a house in Brisbane, as it has just been dubbed the most stable city in Australia. REIQ chief executive Antonia Mercorella said sellers were experiencing higher returns on what they paid for properties and buyers and homeowners could have confidence in the market because of the steady growth.

“We prefer this consistent, sustainable growth over a period of time rather than a booming market,” she said. “This allows consumers, both vendors and buyers, to have confidence in what the market is doing so there are no nasty surprises around the corner.”

“Whether you’re a local or interstate investor, we have some of the strongest rental returns around the country,” she said.

Pete Wargent – CEO, AllenWargent Property Buyers

Brisbane racks up 14th consecutive quarterly gain

The most steadily consistent performer has been Brisbane, notching up another solid +1.6 per cent increase for its 14th consecutive quarterly gain and a +4.2 per cent annual increase. Since June 2012 dwelling prices have increased steadily by +17.1 per cent in Brisbane. Adelaide has followed a very similar trajectory with somewhat more suppressed nominal price growth.

Andrew Bell – CEO, Ray White [Gold Coast] and Louis Christopher – CEO, SQM Research

Strong 2016 predicted for Gold Coast real estate

Ray White’s Andrew Bell believes the Gold Coast will continue to attract attention for the foreseeable future, helped into the investment spotlight by worsening affordability in markets such as Sydney and Melbourne.

Because our prices hadn’t gone up so much recently our yields are more attractive than in other areas and our vacancy rate, which I believe is down to around 1.7% is only going to help that.

The other thing is that I think people see the area as a safer market now because of the substantial development we’ve got going on. It’s bringing tradesmen, engineers, architects and those in a range of other industries associated with it and that’s helping employment and the economy here.

While the 2018 Commonwealth Games has resulted in an injection of funding into the area, Bell said the development occurring currently goes beyond that one off event.

There’s something like $10 billion dollars of worth of expenditure happening here at the moment. That’s a combination of government spending as well as private operations like Jupiter’s. There’s a real sense of optimism and renewed confidence throughout the area. Bell also believes the Gold Coast could start to take some of the investment limelight from Brisbane. Louis Christopher, head of SQM Research, last year gave the region his vote of confidence, predicting values to rise by 7% – 11% during 2016, with rents growing at around 8% in 2016. “We believe Gold Coast property investors are likely to enjoy good returns, both in rents and capital growth for up to the next three years,”

CoreLogic – Regional Market Report

Tourism helps boost home values in Gold Coast region

Since late 2014, Gold Coast home values have been steadily trending upwards as the Gold Coast’s tourism market has improved, according to CoreLogic’s regional market report. Over the year to June 2016 house values increased 7.4 per cent, from $533,571 one year earlier to $572,827.

Herron Todd White – Market Information

Our pick is both Ormeau and Pimpama to be sustained performers in the northern growth corridor [South-East Queensland], supported by surrounding developments and infrastructure increasing amenities, proximity to transport, shopping centres and the M1 Pacific Highway. Furthermore, investors still view these areas as good value for money compared to the Sydney and Melbourne fringe development areas.

Source: http://www.htw.com.au/Downloads/Files/280-Month_In_Review_April_2016.pdf

Brisbane Lord Mayor Graham Quirk – brisbanetimes.com.au

Brisbane’s skyline to be transformed in 2022

Brisbane Lord Mayor Graham Quirk has described the year as a “game-changer” for the city, with a string of major projects set to be delivered in six years’ time.

More than $10 billion worth of major projects were due to be completed in 2022, including the Queens Wharf casino and entertainment complex, the Howard Smith Wharves redevelopment and the Brisbane Quarter on the site of the old Supreme Court building.

Add to those projects Brisbane Airport’s new $1.3 billion parallel runway, the $1.54 billion Brisbane Metro rapid transit system and a new $100 million cruise ship facility at Luggage Point and Cr Quirk said the city was in a position to capitalise on sustained economic growth.

“Greater Brisbane’s economy has seen rapid expansion. It’s now estimated to be worth $146 billion, which is almost half of Queensland’s economic output and is on track to reach $217 billion by 2031.”

Con Makris – goldcoastbulletin.com.au

South Australian billionaire Con Makris relocating HQ to south-east Queensland

South Australian billionaire Con Makris has decided south-east Queensland is the future and is moving his head office to the Sunshine State. He has based his business in Adelaide for the past 45 years.

Mr Makris said the moves were a result of his perception that Brisbane and the Gold Coast would have “astronomical” growth.

“It’s already happening and we want to be here on the ground to capitalise on that growth,” he said.

How we can help…

Through our Real Investar Program we can help you develop and implement a property investment plan.

In simple terms, we’ll work with you to set a passive income goal, then we’ll help you buy the right property in the right areas so you can achieve your goal in the shortest amount of time.

We can take care of everything from finding the property and arranging finance to helping you get the right tenant.

>> For more info and to get started click here

Cheers

Sam & Matt

Urbantech Group

Adelaide Mortgage Broker +plus more…

PS. Over the next few weeks we’re going to review a range of SEQ property investment opportunities so you can get a feel for the sort of returns investors are achieving. Stay tuned…

[We’ve also sourced a couple of promising local Adelaide investment opportunities – so we’ll send you details of these too.]

PPS. Haven’t read our emails lately and want to get up to speed – our recap email has all the links to our recent 7-part finance & property investment article series. And if you’re at all concerned about doomsayers predictions of a ‘property bust’ then I recommend you read this article and this one too – it should put things into perspective.