- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

Season’s Greetings…

How to build a passive income of $83,200 per year with only 4 investment properties!

How to eliminate bad debts and pay off your mortgage in record time!

*Updated: [date]

Most wealthy people are not born into wealth – they create it themselves.

In fact, wealthy people are wealthy for the simple reason that they’ve made different decisions compared with the rest of us.

After all, it’s not how much money you earn but what you do with it that really matters…

Understanding Good Debt & Bad Debt

If you were given an extra $100 per week, how would you use it?

Would you put it towards holding costs on a new investment property OR payments on a new car lease?

I know what I would rather own in 20 years time!

What is Good Debt?

Good Debt also referred to as investment debt or deductible debt, is debt that is used to buy investments or assets that appreciate in value and/or create an income.

Generally these assets put money in your pocket, so by definition most investment property, shares and business debt is considered good debt. Because these assets increase in value as you pay down the debt over time your equity and therefore overall wealth position improves.

Good debt is tax deductible.

What is Bad Debt?

Bad Debt also known as consumer debt or non-deductible debt, is debt used to buy consumer goods that do not appreciate in value or create an income.

Generally these items suck money out of your pocket, so by definition even your home loan debt should be considered a bad debt. Other types of bad debt include personal loans, credit cards, store cards and any other type of consumer finance. Items purchased using bad debt often decrease in value faster than you can pay off the debt, as a result you either end up with no equity, or worse, negative equity and thus reduced overall wealth.

Bad debt is not tax deductible.

The Challenge…

It’s up to you to determine whether you use debt and leverage to create wealth or to fall into even more ‘bad debt’…

The challenge is for you to eliminate all of your bad debts so you are only left with good [investment] debt.

So how do you reduce your bad debts and get on the path to creating real and lasting long term wealth?

Here’s the answer…

*The Golden Rule of Debt Reduction & Wealth Creation*

Spend less than you earn, save the difference and use your savings to pay down or completely eliminate your non-deductible ‘bad debt’, whilst leveraging and using ‘good debt’ to invest in income producing and appreciating assets!

This really is the ‘secret formula’ for becoming wealthy.

To get started, let’s examine some of the key ways in which you can reduce and better manage your expenses & debts…

Debt Reduction Strategies

There are a range of strategies you can use in order to reduce your everyday spending, ongoing interest repayments and overall debt levels, saving you thousands!

These include;

- Budgeting – Set up a budget to monitor your spending and reduce unnecessary costs.

- Refinance – Refinance your current debts to a lender with cheaper interest rates.

- Restructure – Convert your home loan to a Line of Credit [LOC], Offset Account or All-in-one transactional loan.

- Restructure – Change the frequency of your loan repayments from monthly to fortnightly.

- Restructure – Convert residential investment loans from principal & interest [P&I] to interest only [IO] repayments.

- Debt Consolidation – Consolidate your high interest debts into your low interest home loan.

- Combine Strategies – use all of the above strategies and redirect all your savings into paying off your non-deductible home loan in record time – saving you thousands in interest!

Once your bad debts are being managed correctly you can progress to the next step…

- Investment – buy appreciating and/or income producing assets using good debt – then release the newly created equity for further investment!

1. Debt Reduction -> Budgeting

Expenses are the single biggest killer of cash flow so you must learn how to Mind Your Own Business [MYOB]

In other words, know what goes in, what goes out and what’s left over each month!

Itemise ALL of your expenses [mortgage, loans, food, medical, insurance, transport, school, entertainment, recreation etc.], then work out how much you should be able to save each month.

Next, direct all of your savings into paying down your highest interest non-deductible debt first. Once this is paid off you need to pay off your next highest interest non-deductible debt, and so on…

To help you stay on track use a budget planner tool or excel spreadsheet.

>> We’ve got an online budget tool here that you can use or you can download a copy of our budget planner report and template at www.urbantechgroup.com.au/budget

– DEBT REDUCTION CASE STUDY –

To see all of our Debt Reduction Strategies in action let’s explore the following scenario;

- You have a Home valued at $500,000 with a principal & interest [P&I] home loan of $350,000 at a rate of 6% pa.

- You have an Investment Property valued at $500,000 with a P&I investment loan of $350,000 at a rate of 6% pa.

- You have multiple Credit Cards and currently owe $30,000 at an average interest rate of 18% pa.

2. Debt Reduction -> Refinance

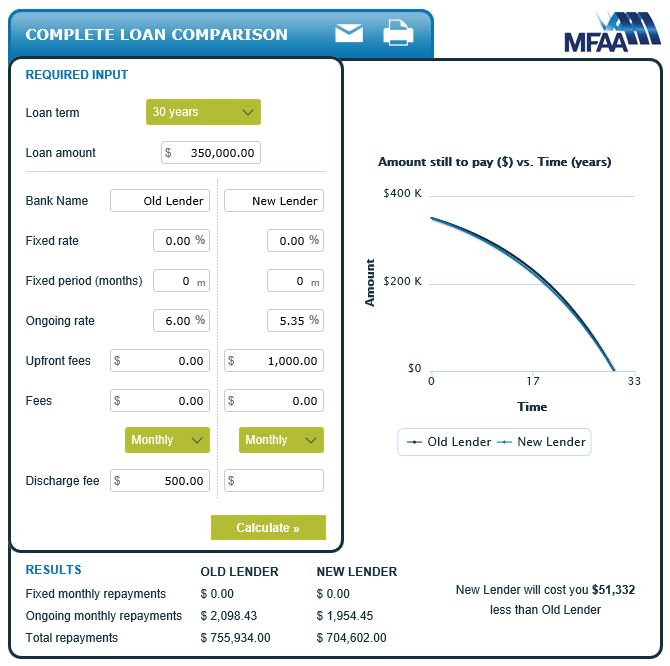

What if you could refinance your current home loan to a lender with cheaper rates?

Taking into account discharge fees and setup fees for the new loan the overall benefit of refinancing from a loan of 6.00% to a reduced rate of 5.35% is $51,332 over 30 years!

In addition, your monthly loan repayments are reduced by $144 each and every month.

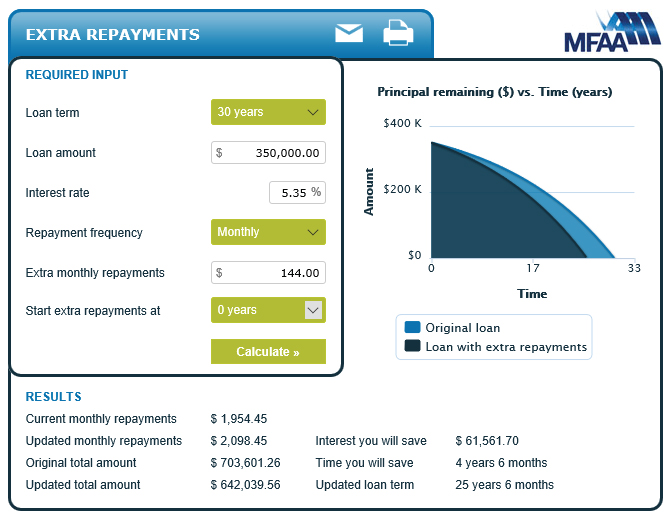

What if you paid this monthly saving of $144 back into your new home loan each month?

Paying an extra $144 per month on your mortgage results in a further saving of $61,561, not to mention a saving of 4 ½ years on the term of the loan!

3. Debt Reduction -> Restructure [LOC/Offset]

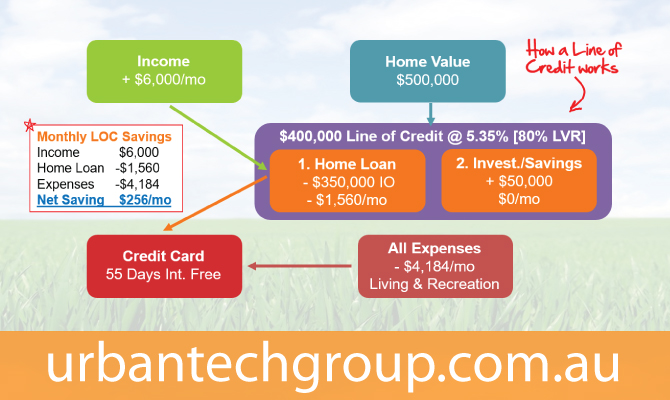

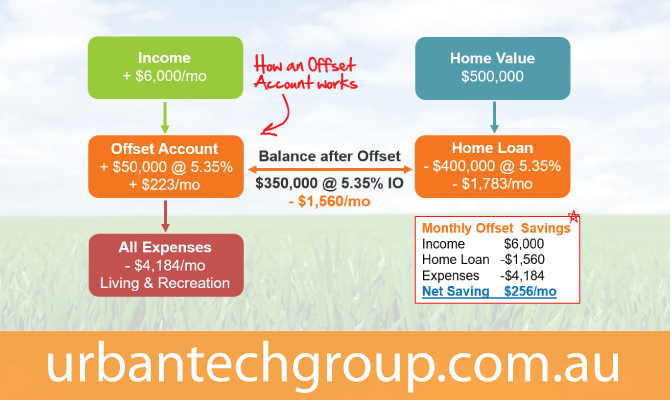

When used correctly a Line of Credit [LOC] or Offset Account can help you save money.

The key is to direct all of your available income and savings into your LOC or Offset account to reduce your loan balance. As interest is calculated daily the longer your funds stay in your LOC/Offset the less interest you will pay.

Tip: Use a credit card for all your expenses to keep your savings in your LOC/Offset for even longer – many credit cards have an interest free period of as much as 55 days!

It’s also crucial you stick to a budget and save more into your LOC/Offset each month than you spend – this way you will pay it down quicker!

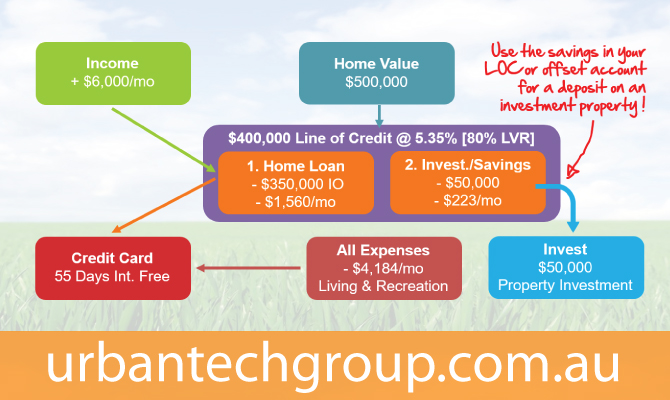

Here’s how a LOC works…

Here’s how an Offset Account works…

Tip: If you have savings that are not earning you the same return as your home loan interest rate then you are losing out. Simply transfer all of your savings into your LOC or Offset Account and you’ll get a return equal to your loan’s interest rate! [eg. 5.35% in this example] Do the same thing with any lump sums of money that you receive from time to time.

Tip: Pay all of your rental income and/or pre-tax business income into your LOC or Offset. This simple strategy can help you to significantly reduce your non-deductible debt [your home loan] while maintaining the full benefit of your tax deductible debt [ie. your investment property loans, business loans etc.].

Investors generally prefer LOC or Offset Accounts as it gives them immediate access to their money. This allows them to act quickly and decisively if opportunities come their way.

Remember, your goal is to spend less than you make and keep the rest in your LOC/Offset to dramatically save on the interest you pay and slash your loan term.

What if you could save money into your LOC each month?

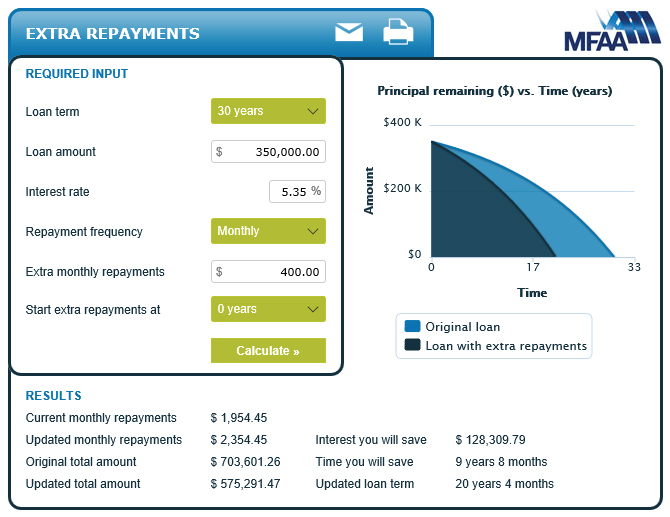

Your combined saving each month now totals $400 per month [$256 per month from your new LOC/Offset structure and a budget, plus $144 per month from refinancing]

Paying an extra $400 off your home loan each month will result in a saving of $128,309 and 9 years and 8 months!

Summary: Refinance your home loan to a cheaper rate loan. Use an Offset Account, LOC or similar structure with a budget to save money into your home loan each month. Using all of the combined monthly savings pay off your home loan in record time!

4. Debt Reduction -> Convert P&I to IO

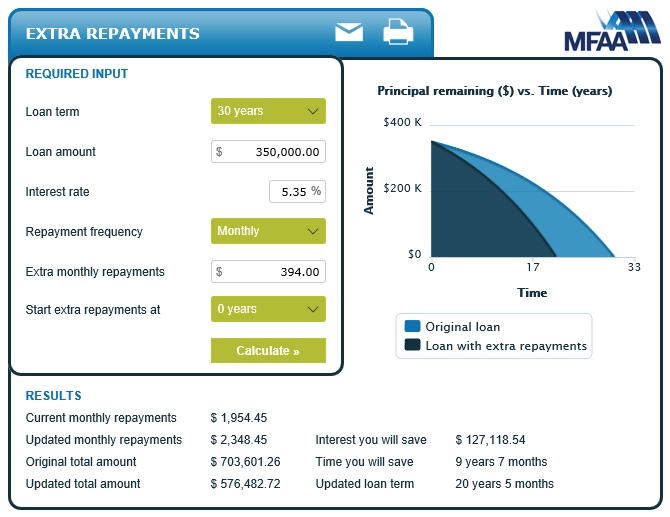

What if you converted your investment loan from P&I to interest only repayments?

Switching to an interest only loan reduces your repayments from $1,954 per month to $1,560 per month – that’s a saving of $394 per month!

Paying an extra $394 off your home loan each month will result in a saving of $127,118 and 9 years and 7 months!

Summary: Convert investment loans from principal & interest [P&I] to interest only [IO] and use the monthly savings to make extra payments into your non-deductible home loan.

5. Debt Reduction -> Debt Consolidation

What are the benefits of Debt Consolidation?

Long Term – Debt consolidation reduces the interest rate you are paying on bad debts [non-deductible consumer debts] so that you can pay them off sooner.

Short Term – Debt consolidation reduces your monthly payments which helps you meet all of your commitments if you’re temporarily struggling with low cash flow.

*Caution – If you’re consolidating debts you need to try and make the same [or close to the same] level of monthly payments you use to on these debts, in order to pay these debts down quickly and avoid prolonged interest charges. Otherwise consolidating short term loans & debts [personal loans, credit cards etc.] into a 30 year home loan can end up costing you a lot more in interest!

Tip: Once you’ve paid off your credit cards you might want to cut them up so you don’t max them out again and defeat the whole purpose of consolidating the debts in the first place. If you had trouble managing your spending the first time, there’s a good chance you might struggle again. One solution is to switch to using a MasterCard/Visa ‘debit card’ instead!

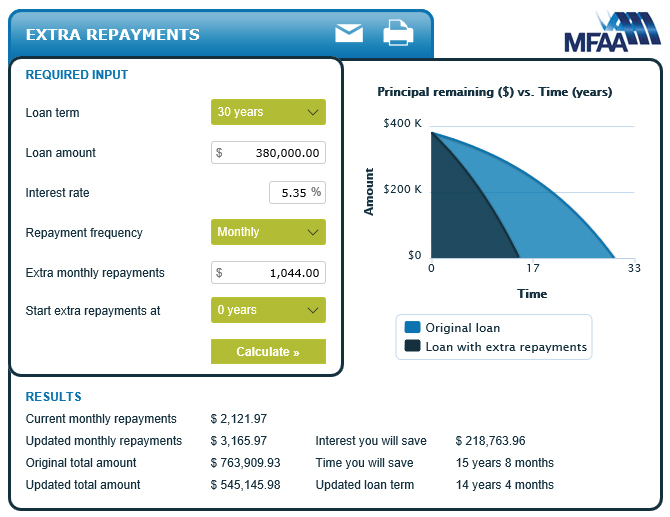

What if you consolidated your $30,000 credit card debt into your low rate home loan?

Paying off your credit cards will save $900 per month [based on 3% min card payment] plus an additional $144 per month from refinancing.

Paying an extra $1,044 per month off your mortgage will result in a saving of $218,764 and 15 years and 8 months!

Note: After consolidating the credit card debt your home loan balance is now $380,000

Summary: Refinance to a better rate, but also consolidate your credit card debt into your low interest home loan. Then use the combined monthly savings [the 3% min card payment] to pay off your home loan in record time!

6. Debt Reduction -> Combining Strategies!

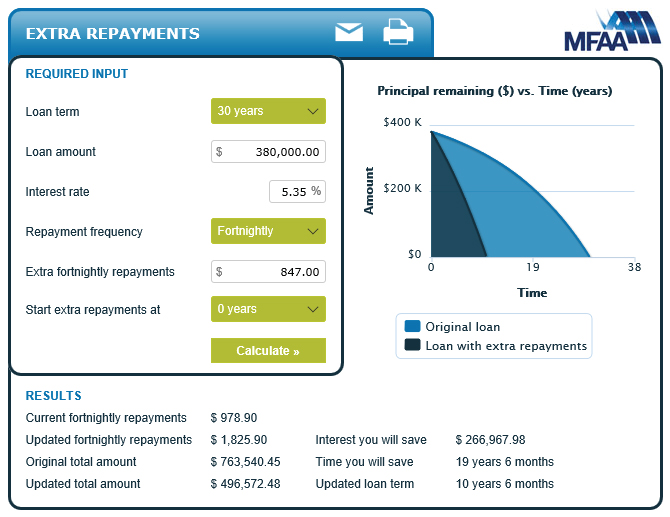

What if you could combine ALL of these debt reduction strategies together?

- Refinancing your home loan to a lender with a 0.65% cheaper interest rate saves $144 per month

- Having the right loan set up and a working budget saves $256 per month

- Converting your investment property loan from principal & interest [P&I] to interest only [IO] saves $394 per month

- Consolidating $30,000 worth of credit cards into your home loan saves $900 per month

By combining all of these debt reduction strategies together you could save a massive $1,694 per month !!

But wait there’s more…

What if you split your monthly mortgage payment and the monthly saving of $1,694 per month in half and instead make an extra payment of $847 each fortnight!

The result is incredible…

…a huge saving of $266,968 and 19 years and 6 months on your home loan!

Summary: Refinance to a better rate and consolidate your credit card debts into your home loan. Use a LOC or similar structure, along with a budget, to save into your home loan each month. Convert investment loans from P&I to interest only and use the total combined monthly savings from all of the strategies to make extra fortnightly payments on your non-deductible home loan!

There you have it, the exact strategies you can use to pay off a $350,000 home loan…

… in just over 10 years;

… saving over $266,000 in interest costs!

Tip: You always want to focus on paying off your most expensive non-deductible debt first. Not your largest debt, but the debt with the highest rate of interest. In our example the highest interest non-deductible debt is the credit card debt, followed next by the home loan debt. The investment loan debt however is 100% tax deductible so you should always pay this off last!

ONE LAST THING…

What if your investment property was cash flow positive [positively geared] to the tune of $100 per week? Why not use this extra income to pay down your non-deductible home loan even faster!

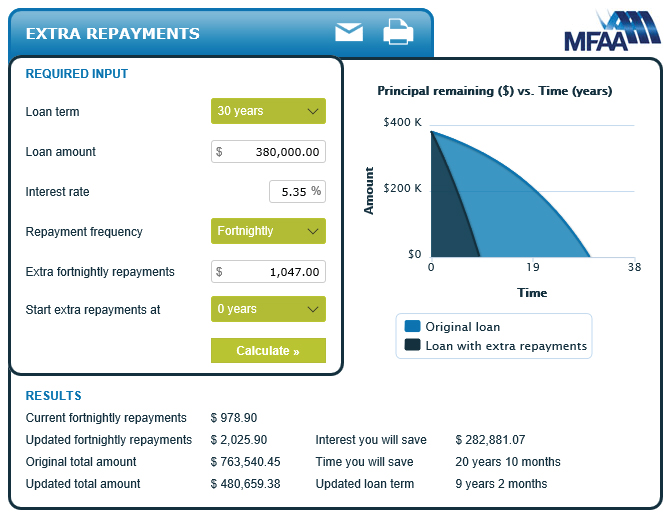

What if you paid this extra property income into your home loan?

With the additional income of $100 per week [$200 per fortnight] you can now make an extra payment of $1,047 each fortnight!

The results are even bigger…

…a huge saving of $282,881 and 20 years and 10 months on your home loan!

WOW!

Ok, so what’s next?…

Do you just focus on paying off debt for the rest of your life?…

No Way! …because unless you’re earning hundreds of thousands of dollars each year there’s just no way you’re going to be able to ‘save’ your way to wealth.

So what now?…

Remember, the final piece of the puzzle: Investment!

While paying off debt helps you to build up equity over time, investing [your equity] is the only way to build true wealth!

The best way to get going is to use the equity you have already built up in your home…

Here’s how that looks;

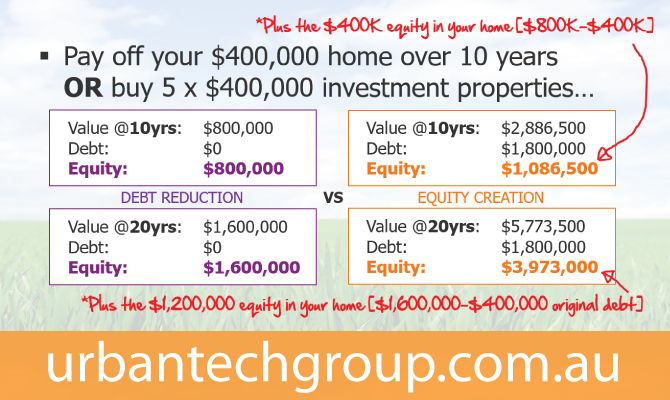

Debt Reduction vs Investment

*Caution – don’t wait until you’ve paid off your home loan before you start investing or you will miss out on years of growth in property!

Remember, The Golden Rule of Debt Reduction and Investment…

Spend less than you earn, save the difference and use your savings to pay down or completely eliminate your non-deductible bad debt, whilst leveraging and using good debt to invest in income producing and appreciating assets!

Let’s assume you had a $400,000 mortgage and each year you were able to save $40,000 …

Would you be better off using your savings to pay off your mortgage in 10 years OR, should you use your savings to purchase multiple investment properties?

Let’s have a closer look…

Note: every second year you use your $80K in savings [$40k x2] to purchase a $400K investment property.

The above diagram compares paying off your home loan over 10 years, with buying 5 x $400,000 investment properties over the same period.

Let’s take a closer look at how the numbers stack up;

By focusing on paying off your home loan you’re left with a freehold asset worth $800,000 after 10 years.

However, buy buying 5 investment properties you end up with net equity of $1,086,500 plus an additional $400,000 equity from your home [$800,000 new value – $400,000 home loan, which has never been paid down]. That’s a total of $1,486,500!

Thanks to the power of leverage your equity grows even faster after another 10 years of capital growth – giving you a total of $5,173,000 [$3,973,000 + $1,200,000] in net equity, compared with only $1,600,000 if you had only focused on paying off your home loan and never invested.

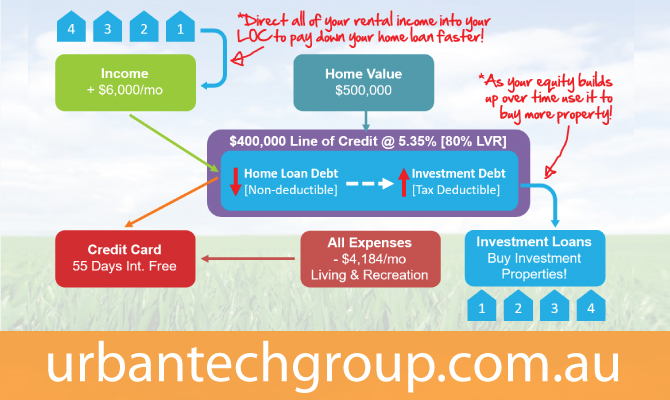

Debt Reduction plus Investment

The overall goal is to combine Debt Reduction AND Investment…

So you pay down your non-deductible debt until you’ve built up enough equity to purchase a new investment property.

…Then repeat!

Over time this process helps you transform all of your non-deductible home loan debt into tax deductible investment loan debt.

Here’s how that looks;

Where to from here?…

We can help you put all of these debt strategies into practice!

We’ve created a property investment coaching program to help you eliminate your bad debts and build a passive income of at least $83,200 by buying only 4 average-priced investment properties.

>> For all details and to get started with our free coaching program click here

If you need any other details or just want to chat further, please contact Sam on 0411 431 391

Cheers

Sam & Matt

Urbantech Group

Adelaide Mortgage Broker +plus more…