- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

Interest rates to rise even if the RBA cuts the cash rate!

Another major bank just hiked their variable rates…

What are your investment options?

*Updated: [date]

There are a lot of different ways you can invest your hard earned savings.

But which one is best?

With so many investment options to help you grow your wealth it can be difficult to find the one that is right for you.

Here’s a list of some of the most popular investment options you have at your disposal;

- Cash

- Shares

- Superannuation/Managed Funds

- Residential Property

- Commercial Property

- Fixed interest/Government Bonds

- Business

- Collectables

There’s no doubt that Australian’s have a bias towards residential property investing.

In fact, according to CoreLogic RP Data residential real estate underpins Australia’s wealth, having a combined total value of $5.7 trillion.

In comparison commercial real estate has a value of $0.7 trillion, listed stocks a value of $1.7 trillion and Australian superannuation is valued at $2.0 trillion.

Unsurprisingly residential real estate accounts for more than half of all household wealth.

A fact not lost on the $2+ million [and increasing] individuals in Australia who currently own one or more investment properties.

Why is property such a popular investment?

Here’s 13 reasons why we think residential property is a great investment vehicle;

1. Time not Timing

Like all markets, property can be cyclical. In Australia, however, property has always recovered strongly after any slowdown.

When approached as a mid to long term investment vehicle, property has rarely failed to produce consistently good returns for investors.

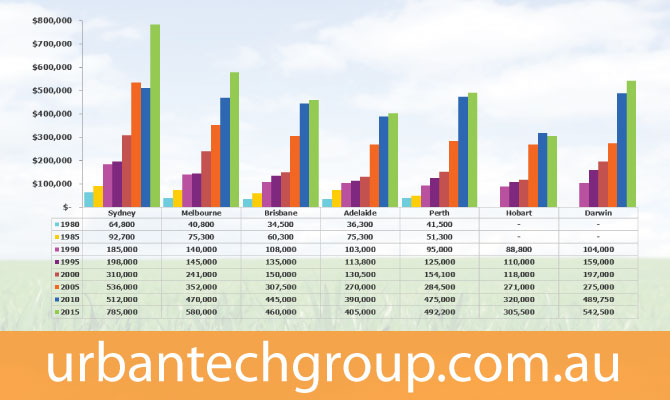

In fact, property values have increased significantly over the past half a century, especially the last 25 years.

While it is possible to ‘time the market’ and make quick profits, short term thinking can also result in short term losses.

That’s why property investment should be treated as a medium to long term strategy. Buy the right property, in the right area and hold it for the long term and you’ll always make money.

It’s time in the market, not timing, that matters!

2. Leverage

You can borrow more to buy property.

By contributing a small portion in the way of a deposit you are able to control an asset of significantly greater value – often up to ten times your investment as in the case of a 90% LVR Loan.

The returns you gain from the asset’s growth are therefore proportionately greater!

Here’s an example;

| Purchase Price: | $400,000 |

| Bank Loan 95% LVR: | $380,000 |

| You Contribute 5%: | $20,000 |

| + Costs ~7%: | $28,000 [Stamp Duty etc. + Mortgage Insurance] |

| + Holding Cost [if any]: | $5,200 [eg. $100 per week shortfall for 1st yr] |

| Total Investment: | $53,200 |

| Market Capital Growth: | 7% pa. [Australian 100yr average – Source: REIA] |

| Your investment 1yr later… | |

| Property Value: | $428,000 [7% Capital Growth] |

| Equity Return: | $28,000 [$428,000 – $400,000] |

| Your Investment: | $53,200 [$20,000 + $28,000 + $5,200] |

| ROI Return: | 52.6% [$28,000/$53,200] |

3. Stability

Although the share market may sometimes perform well overall, the share prices of individual companies can be incredibly volatile!

Corporate collapses have seen many peoples’ investments reduced to zero or just a few cents in the dollar.

Do you remember these high profile examples; Borders, Colorado, ABC Learning Centres, Opes Prime, Storm Financial, Westpoint, HIH, Ansett, Lehman Brothers, AIG, Enron etc…

Unlike a business however, residential property cannot go bust!

4. Return on Investment

A 25+ year analysis of several different asset classes by Russell Investments has shown residential property produced the highest return on investment.

You can see the chart here;

Overall residential property values in Australia have experienced a gradual and steady rise.

According to the REIA, property has risen on average by 7% per year, compounded, over the last 100 years.

Remember success leaves clues – 80% of the wealthiest 200 Australians have made or hold a significant proportion of their wealth in property.

5. Population Growth

The Australian Bureau of Statistics estimates an overall total population increase of one person every 2 minutes and 9 seconds.

Applying the simple rules of ‘supply & demand’, there is unlikely to be any major slowdown in the ongoing need for residential housing in the foreseeable future.

6. Demographics

The statistics show us that Australians are living longer, families are getting smaller and single person households are increasing.

These factors mean that more houses and units are needed per head of population, reinforcing the underlying strength of both current and future market demand.

7. Interest Rates

Because of the perceived stability and security of residential property, home loans are the cheapest form of debt available.

Interest rates are currently at record lows in Australia and are forecast to go even lower!

In fact, the cash rate in many countries is already at 0%.

Here’s a look at some interesting charts;

8. Control

With property, you can choose how your asset is to be managed and the extent of your involvement. You’re the boss!

Unlike the situation with shares, property trusts or superannuation – critical decisions impacting on the value of your investment are left for others to make.

9. Adding Value

You can add value to property in a range of ways [renovations, additions, obtaining redevelopment or subdivision approval etc…] – and for a relatively small cost, the returns can be substantial.

With most other forms of investment there is very little that you can do personally to enhance the value of your investment.

10. Inflation

Over time the cost of building materials, labour and related services rise due to inflation. This increases construction costs which along with appreciating land prices forces up home prices.

As landlords increase rents to keep pace with inflation, higher rents ultimately lead to higher home prices.

11. Rental Income

Over time, rental income from a property will generally increase in line with rising property values, while loan repayments can be fixed.

Your investment property will eventually become ‘cash flow positive’, whereby the rent will cover the entire monthly loan repayment, as well as put some money back in your pocket.

12. Tax Advantages

Investment properties provide some of the biggest legitimate tax deductions.

Most of the expenses you incur in relation to buying, maintaining and managing a rental property are tax deductible.

You can also claim a tax deduction for the depreciation of your property and its fixtures & fittings – all these deductions can significantly reduce your tax bill!

To estimate the likely depreciation deductions for your investment property you can use this calculator

13. Source of Equity

Banks offer facilities enabling you to access the increased equity in your property as it grows in value [ie. line of credit and offset accounts].

You can use this equity to buy more property or even to improve your current lifestyle.

This means you don’t need to sell your asset to tap into its increased value and expand your investment property portfolio!

There it is, 13 reasons why we think residential property is a great investment option.

What do you think of the above list? Let us know in the comments below.

Want to become a Real Investar…

We’ve created a property investment coaching program that can help you eliminate your bad debts and build a passive income of at least $83,200 per year [~$1,000 per week net] by buying only 4 average-priced investment properties.

>> For all details and to apply for our free coaching program click here

If you need any other details or just want to chat further, please call Sam on 0411 431 391

Cheers

Sam & Matt

Urbantech Group

Adelaide Mortgage Broker +plus more…