- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

Fixed Rates from as low as 4.14%

The RBA’s interest rate statement for March 2015

Understanding Reverse Mortgages

A reverse mortgage is a complex product that can have a significant impact on your finances and relationships, and your quality of life in retirement.

This post discusses some important things to consider before you decide to take out a reverse mortgage. You should also seek independent financial and legal advice, and speak to your partner and family before you jump in.

How reverse mortgages work

A reverse mortgage allows you to borrow money using the equity in your home as security. The loan can be taken as a lump sum, a regular income stream, a line of credit or a combination of these options.

While no income is required to qualify, credit providers are required by law to lend you money responsibly so not everyone will be able to obtain this type of loan.

Interest is charged like any other loan, except you don’t have to make repayments while you live in your home – the interest compounds over time and is added to your loan balance. You remain the owner of your house and can stay in it for as long as you want.

You must repay the loan in full [including interest and fees] when you sell your home or die or, in most cases, if you move into aged care.

The risks

- Interest rates are generally higher than average home loans

- The debt can rise quickly as the interest compounds over the term of the loan – this is the effect of compound interest and is something you need to be aware of before making any decisions

- The loan may affect your pension eligibility

- You may not have enough money left for aged care or other future needs

- If you are the sole owner of the property and someone lives with you, that person may not be able to stay when you die [in some circumstances]

- If you fix your interest rate then the costs to break your agreement can be very high

Negative equity protection

On 18 September 2012, the Government introduced statutory ‘negative equity protection’ on all new reverse mortgage contracts. This means you cannot end up owing the lender more than your home is worth [the market value or equity].

When the reverse mortgage contract ends and your home is sold, the lender will receive the proceeds of the sale and you cannot be held liable for any debt in excess of this [except in certain circumstances such as fraud or misrepresentation]. Of course where your home sells for more than the amount owed to the lender, you or your estate will receive the extra funds.

If you entered into a reverse mortgage before 18 September 2012, you’ll need to check your contract to see if you are protected in circumstances where your loan balance ends up being more than the value of your property.

Even though the negative equity protection only commenced in law in September 2012, if your lender is a member of the Senior Australians Equity Release Association of Lenders (SEQUAL) they also will only offer reverse mortgages that protect you from negative equity.

How much can you borrow?

The older you are, the more you can borrow. Different lenders have different policies about how much they will let you borrow.

As a general guide, if you are 60 the maximum amount you can borrow is likely to be 15-20% of the value of your home. You can usually add 1% for each year older than 60. That means if you are 70, the maximum amount you could borrow would be about 25-30%.

The minimum amount you can borrow may depend on the provider. It could be as low as $10,000. Keep in mind that if you borrow the maximum amount now, you may not have access to any more money later.

How much will it cost?

The cost of the loan depends on the interest rate and fees. The main issue is that as the interest compounds, the debt will grow rapidly.

Some reverse mortgage products also allow you to protect a portion of the value of the property. For example, you might want to ensure that you have $200,000 left in case you need a bond for an aged care hostel. Use our reverse mortgage calculator to explore your options.

If you are borrowing money from a lender other than an Authorised Deposit-taking Institution such as a bank, building society or credit union, by law they must not charge more than 48% interest including all fees and charges.

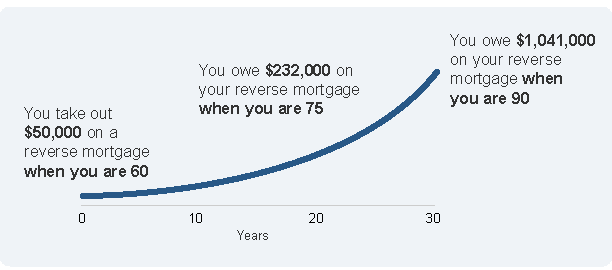

The graph below shows how compound interest could make a debt grow from $50,000 to $232,000 over 15 years. Over 30 years it could grow to over $1 million.

Note that, with statutory negative equity protection (for contracts entered into after 18 September 2012), your debt cannot grow to an amount greater than the market value of your home.

Assumptions: $50,000 loan at age 60, no regular withdrawals, interest rate of 10% calculated and charged monthly, $1200 establishment fees, $9 monthly fees added to loan balance.

Questions to ask the reverse mortgage provider

Before you sign on the dotted line, check the following.

Reverse mortgage information statement

Do you understand how a reverse mortgage works? Your credit provider or credit assistance provider [mortgage broker] must give you a ‘reverse mortgage information statement’.

The information statement includes:

- Details about how a reverse mortgage works

- How costs are calculated

- What to consider before taking out a reverse mortgage

- Useful contacts for more information

Reverse mortgage projections

What is the long term impact of a reverse mortgage? Your credit provider or credit assistance provider must go through reverse mortgage calculations with you – in person, before you take out a reverse mortgage – using our reverse mortgage calculator.

These projections will:

- Illustrate the effect a reverse mortgage may have on the equity in your home over time

- Show the potential impact of interest rates and house price movements

Make sure you understand these projections and how changes in circumstances could change how much equity you hold in your home. Take your time and ask the reverse mortgage provider to explain it to you if there’s anything you’re not sure about.

When they go through the calculator with you they must give you a printed copy of these projections to take with you. Be aware that the projections are only an estimate and not a guarantee of how much equity you will have should you take out the loan.

Security

Check if the lender will accept a holiday home or investment property as security so the family home can remain debt-free. Find out if there are any special arrangements if your home is already mortgaged.

Special terms and conditions

Ask if there are any restrictions on what you can do with the money.

Cooling-off period

Check if there is a cooling-off period so you can pull out if you change your mind.

Life changes

Find out what happens if you or your spouse dies, or if you need to transfer the loan to another house if you move. Check if you need the lender’s permission to sell, lease, vacate or renovate your home or have someone move in with you.

Non-title-holding residents

If you are the homeowner and someone else is living with you, the other resident may have to move out when the loan becomes repayable. Some reverse mortgage contracts may protect the rights of the other (non-title-holding) resident by allowing them to stay in the home. If you want this option, make sure you discuss this with your lender before taking out a reverse mortgage.

If things go wrong

Ask the lender what external dispute resolution scheme they belong to. Then you will know where to go if you have a problem. Find out how to complain if you need to resolve a dispute.

Do your own research

Be proactive and do some homework before you sign up.

Be proactive and do some homework before you sign up.

What is the impact on your social security?

Talk to the Department of Human Services’ Financial Information Service to check how a reverse mortgage would affect your pension entitlements.

Think about your future and what costs there might be

You may not want to think too far into the future or about how your health and living situation might change 10, 20 or even 30 years from now. But it is important that you start planning now for the extra costs you could incur like medical expenses and aged care, so that you will have enough money left to cover them.

Check SEQUAL membership

Some reverse mortgage providers are members of SEQUAL (an industry association). All their members agree to minimum standards (such as no negative equity guarantee).

How should you take the loan?

You can take the loan as a lump sum, regular income stream, line of credit or a combination of these options. Regular income stream payments may be less costly than a lump sum. Use our reverse mortgage calculator to work out the most cost-effective options.

Get independent legal advice

Ask your legal adviser to explain the fine print of the reverse mortgage contract so you understand the consequences of breaching any terms and conditions.

A reverse mortgage can be useful to relieve financial pressure or improve your lifestyle. Be aware of the conditions of the loan and the choices available. Use a licensed mortgage broker and seek financial advice before you commit to a reverse mortgage.

If you need any other details or wish to discuss your situation please feel free to contact us any time.

Sam & Matt

Urbantech Group

Adelaide Mortgage Broker +plus more…