- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

The RBA’s interest rate statement for May 2013

The RBA’s interest rate statement for June 2013

Building your investment plan

Step 3. Investment

Step 3. Investment

The challenge… you just can’t earn or save your way to wealth creation.

This brings us to the final piece of our 3-Step Personal Finance Business Plan

… Investment!

While paying off debt helps you to build equity over time, investing [your equity] helps you to build true wealth.

What are your financial goals?

To build wealth you need an investment plan but before you get started you first need to understand ‘why’ it is important for you to improve your financial wellbeing. You need to develop a vision of a better financial future.

A good way to start is by asking yourself the following questions;

- What would you love to do if money was no longer a problem?

- What would be your true purpose and passion in life?

- What have you always wanted to do?

- What would your new life look like; what type of car, house, holidays, leisure activities, family and friends?

So how much would you need to fund your new lifestyle?

Where do you fit on the table below and what level of passive income do you need/want to achieve, in order to comfortably retire and fund your new lifestyle.

| Broke | $400 net per week |

| Just Getting By | $500 net per week |

| Moderately Secure | $600 net per week |

| Independent | $1000 net per week |

| Financially Free | $2000 net per week |

| Wealthy | $4000 net per week |

For the purpose of this example I’m going to assume that everyone wants to be wealthy 😉

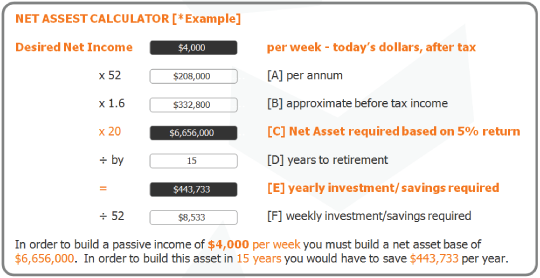

Therefore the aim of your investment plan is to earn a passive income of $4,000 per week. I’m also going to assume that you’re willing to wait 15 years until you retire and start enjoying your new lifestyle.

Let’s say you’re able to conservatively achieve an investment return of 5% per annum, what level of assets will you need in order to provide an income of $4,000 per week at retirement;

Analysis…

Can you save $443,733 every year for 15 years straight? For the majority of Australians, this is completely out of the question!

In fact, many people are lucky to have accumulated a total of $443,733 in superannuation funds by the time they retire.

So if you can’t save your way to a passive retirement income of $4,000 per week, or accumulate enough superannuation, your only option is to build a different sort of investment plan – one that can ensure you achieve your goals.

In most situations the asset class that will give you the most amount of leverage and thus allow you to build a substantial passive income the quickest is residential property.

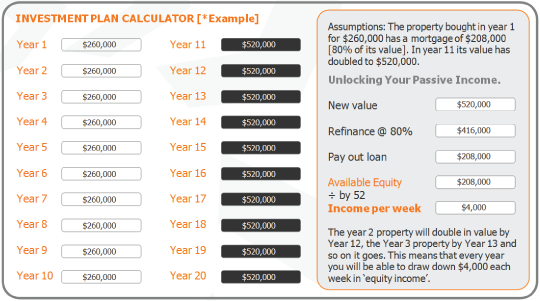

Did you know that if you bought one inexpensive investment property each year for ten years you could potentially retire on a tax free passive income of over $4,000 per week?

All it takes is for you to build a plan and to stick to it!

Building your Investment Plan.

In most cases residential property is the best investment vehicle for wealth creation particularly as it provides more leverage compared with shares or business. However, the great debate regarding property investing has always been whether you invest for capital growth or for cash flow.

Historically property values have doubled every 7 to 10 years [source: REIA] so if you were able to buy enough property and hold it for one full cycle, you could potentially create a large amount of equity.

So to build an asset base the quickest we believe the average person should invest for capital growth, rather than for cash flow.

For example, if the average ‘cash flow positive’ property gave you $40pw in your pocket then to build a passive income of $4,000pw you would have to buy 100 properties. Now that is a lot of properties to buy and manage for a $4,000 per week ‘taxable’ income!

If you invest for capital growth you might only have to buy 10 inexpensive properties to get a ‘tax free’ income of $4,000 per week. [we’ll show you how in a bit]

The flipside however, is that the average capital growth property is often slightly ‘cash flow negative’ [negatively geared] and as such may cost you around $20-50pw. Therefore you’ll need an alternative cash flow source to service this shortfall until your rental returns increase – this could be your PAYG income, a couple of ‘cash flow positive’ properties you buy, and/or income you’ve generated from investing in cash flow based investments [ie. managed funds etc.]

Our Investment Plan Calculator will tell you ‘what’ you need to do in order to achieve your desired passive income.

Note: In the example below we have assumed that the investor has sufficient income to service 10 capital growth properties worth $260,000 each.

To download a blank investment plan calculator click here [use the password freedom1 to unlock it]

Analysis…

The key to the above investment plan is to ‘refinance’ each property after it has had 10 years’ worth of capital growth.

The problem with ‘selling’ an investment property is that you no longer have the asset and so you miss out on the capital growth in the next 10 years, and the 10 years after that. The other downside is that you will have to pay capital gains tax if you sell and this will reduce your overall profits which would require you to buy even more property to build the same level of income. Instead, when you refinance the property after 10 years you are able to draw out the capital growth or equity that has built up.

It’s true that you are increasing your mortgage and in addition your loan repayments each time you refinance, however, as the property is tenanted you will be receiving rent to offset your increased repayments. Remember, not only has your property increased in value but so has your rental income. The best part is that when your refinance, the money you release is borrowed money and therefore is not subject to tax.

The goal of the above example is to buy one property worth $260,000 each year, for a total of ten years. You could however, buy one property worth $520,000 every two years and still achieve the same result or even buy one property worth $870,000 every five years. In fact, it doesn’t matter what combination of property you buy as long as you develop a plan and stick to it!

Do you currently have an investment business plan or are you planning to fail?

If you stopped work today and if you did not change your lifestyle in any way, how long could you live off of your current investments and savings?

- Forever

- For the next 10 years

- For the next 5 years

- For the next 1 year

- For the next 3 months

- For the next week

The Facts of Life.

The Facts of Life.

What are you currently earning?

Did you know 70% of adult Australians earn less than $60,000 per year? In fact, only 8% of adult Australians earn more than $100,000 per year, while just 2% earn more than $208,000 per year, or $4,000 per week.

What income will you need when you retire?

A massive 71% of adults Australians who make it to the age of 65 live on $400 per week or less, dependant on the pension or their families. Only 6% of Adult Australians who make it to 65 earn $1,000 per week or more! [Source: ABS Census, ATO]

Just to survive these days you require at least $400 net per week – that’s approximately $33,000 gross per year. Using the Net Asset Calculator above you can see that you would still need $500,000 in net assets [cash, shares, property] returning you 5% per annum [before tax] to achieve a $400 per week income.

Why do 94% of Australians aged 65 retire virtually broke?

There are the usual suspects; too much bad debt or consumer debt, mistaken belief that their superannuation and/or the pension will sustain their current lifestyle, or that their debt free home is a large enough asset to fund their retirement.

One of the major reasons people retire broke is that they have simply never spent the time to build an investment business plan. The fact is that some people are just too lazy to start, others start too late and most just don’t bother to think about it until it is too late.

Where to from here?

For more details on how you could potentially retire in 10 years on an after tax income of $208,000 we recommend you download [and read] our free 180+ page Smarter Finance & Wealth Creation Guide

Don’t be put off by the size, the font is really big and you’ll be able to whip through it in no time. Here’s some of what you’ll learn;

- The Facts

- Property Fundamentals

- Comparing Investments

- Property Investment

- Finance

- Creative Finance

- Wealth Creation

- The 4-Month Investment Plan

- The 10-Year Investment Plan

- What next…

The aim of this information is to help you build a simple plan of ‘what’ you need to do. If you are interested in learning exactly ‘how’ you can build an investment property portfolio then you should consider having a chat to us about your situation. We recommend you request a free Finance & Wealth Evaluation to get the ball rolling.

P.S. In case you’ve missed our previous posts on the 3-Step Personal Finance Business Plan here they are; Step 1. Spending Management & Step 2. Debt Management

All the best.

Sam & Matt

Urbantech Group

>> Adelaide’s Best Home Loans +plus more…