- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

Mind your own business

Learn how to renovate property in 70 hours or less…

Getting the better of debt!

Step 2. Debt Management [Continued…]

Step 2. Debt Management [Continued…]

Spend less than you earn, save the difference, and use your savings to pay down your bad debt and to invest in appreciating and/or cash flow producing assets.

That’s pretty much the crux of our 3-Step Personal Finance Business Plan – it all comes down to how well you can master the areas of spending management, debt management and investment.

We’ve already spoken in detail about managing your spending and developing a budget and savings plan, and in a recent post we discussed the difference between ‘good debt’ and ‘bad debt’ and introduced the concept of debt management …

…now it’s time to show you the money!

When it comes to handling debt most people fit into one of the following scenarios;

- Going Backwards – you’re struggling, plain and simple. You are barely able to meet your financial commitments each month and regularly find yourself taking on more [bad] debt just to survive. If this is you, then you need debt management to stat in the game so to speak. However, rest assured with the right strategies it won’t be long before you find your feet again and get back on track.

- Going Sideways – you’re able to meet all of your monthly commitments comfortably but because you’re not managing your debts well you find you’re just not saving enough money or paying down any of your bad debts. If this is you, then debt management is going to help you get great results in no time!

- Going Forward – you’ve implemented a number of debt management strategies and find yourself in total control of your finances. You’re spending much less than you make and you’re using the savings to help you pay off your bad debt in record time. Plus, you’re using good debt to invest in assets that appreciate over time and create additional cash flow.

So how do you get the better of debt?

How do you reduce your loan interest costs, pay down your debts and save hundreds of thousands of dollars?

Here’s a few things you can try;

- Refinancing your debts to a lender with cheaper interest rates

- Changing the type of loan you have ie. switching to an offset account of line of credit loan

- Changing the frequency of your loan repayments

- Converting your investment loans to interest only

- Consolidating high interest debts into your home loan.

- Combining multiple strategies

To see how each of these strategies work let’s consider the following scenario;

– You have a Home valued at $450,000 with a principal & interest loan of $350,000 at an interest rate of 6% per annum.

– You have an Investment Property valued at $450,000 with a principal & interest loan of $350,000 at a rate of 6% per annum.

– You have multiple Credit Cards and currently owe $30,000 at an average interest rate of 18% per annum.

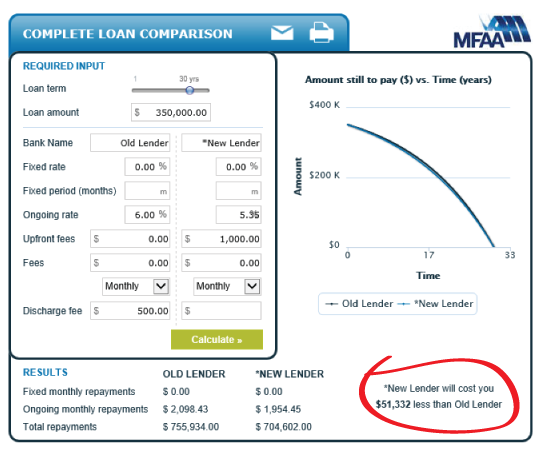

1. Refinancing

What if you could refinance your current home mortgage to a lender with cheaper rates?

Note: This assumes you’re able to refinance from an interest rate of 6.00% to a loan with an interest rate of 5.35%

Taking into account discharge fees and setup fees for the new loan the overall benefit of refinancing is $51,332 over 30 years

In addition, your ongoing monthly loan repayments have been reduced by $144 each and every month.

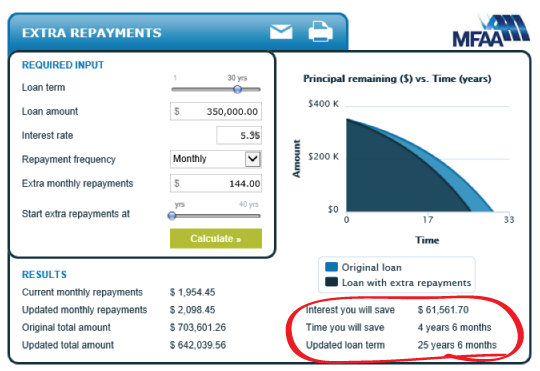

What if you paid the saving of $144 back into this new home loan each month?

Paying an extra $144 on the mortgage each month results in a further saving of $61,561 , not to mention a saving of 4 1/2 years on the term of the loan.

What if instead you paid an extra $144 per month off your credit card each month?

Note: The minimum monthly payment on a credit card is 3% of the outstanding balance. If you only ever pay this minimum amount it will take you just under 4 years to pay off your credit card debt.

Paying an extra $144 off the credit card debt each month results in a saving of $2,505 and 9 months off the expected loan term.

More importantly, with the credit debt paid off you’re now able to save an extra $900 per month [previous monthly payment = 3% of $30,000 per month = $900 per month]

Now what if you paid the initial saving of $144 per month and the credit card saving of $900 per month into your new home loan each month?

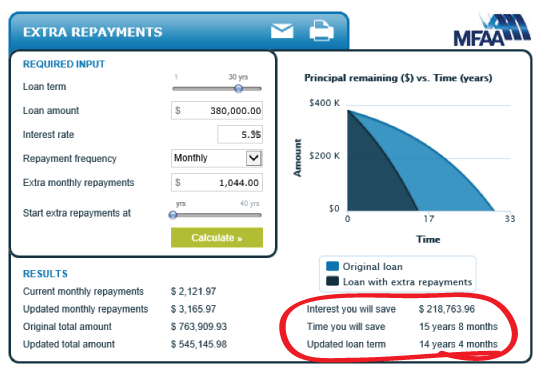

Note: The extra payment of $1,044 [$144 + $900] can only be made after 4 years as it will take close to that amount of time to pay off the credit card debt as previously discussed.

Check out the results! How does saving $157,073 in interest and 13 years and 5 months on your home loan sound!

Summary: Refinance your home loan to a cheaper rate loan. Use the monthly savings to pay off your credit cards sooner. Use all of the combined monthly savings to pay off your home loan in record time!

2. Loan Type & Structure

What if you could save additional money into your loan each month?

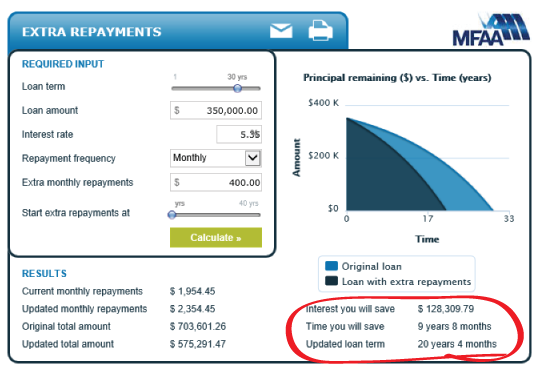

Note: Using an offset account or a loan with redraw facilities can assist people to save extra money into their loan each month, particularly is they adhere to a controlled spending plan. Therefore in addition, to the $144 per month saving from refinancing, we’re assuming you could save an additional $256 per month by having your loans structured correctly and by following a budget. This would take your overall saving to $400 per month.

Paying an extra $400 [$144 + $256] off your home loan each month will result in a saving of $128,309 and 9 years and 8 months

Summary: Refinance your home loan to a cheaper rate loan. Use an offset account or similar structure along with a budget to save money into your home loan each month. Using all of the combined monthly savings pay off your home loan in record time!

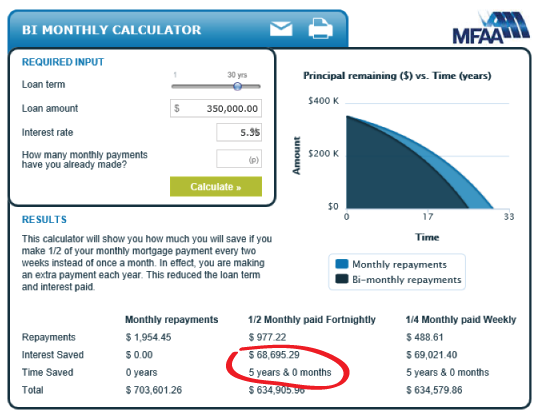

3. Loan Payment Frequency

What if you halved your monthly mortgage repayment and paid it fortnightly instead of monthly?

By paying half of your monthly mortgage payment each fortnight you’re able to save $68,695 and 5 years off your home loan!

Summary: Pay your mortgage payments fortnightly. You won’t notice any difference and it will help you pay off your home loan sooner.

4. Pay Interest Only on Good Debt

What if you converted your investment loan [good debt] to interest only?

The principal and interest loan [p&i] repayments on your $350,000 investment loan are $1,954.45 per month.

Switching to interest only reduces your repayments to $1,560.42 per month [$350,000 x 5.35/12] – that’s a saving of $390 per month!

If you take this investment loan saving of $390 per month and put it into your home loan each month the savings are huge. [*scroll up to see the previous example where we showed the benefit of paying an extra $400 into your home loan each month]

Summary: Convert investment loans from principal and interest to interest only and use the monthly savings to make extra payments on your non-deductible home loan.

5. Debt Consolidation

What if you consolidate your $30,000 credit debt into your home loan?

Instead of taking 3-4 years to pay off your credit card debt simply consolidate it into your home loan.

While your home loan will increase to $380,000 you’ll save $900 each month by not having any credit cards.

As a result you’ll be able to pay an extra $1,044 [$144 + $900] off your mortgage each month.

Over 30 years this equates to a saving of $218,763 in interest and 15 years and 8 months!

Summary: Refinance but also consolidate your credit card debt into your home loan. Use the combined monthly savings to pay off your home loan in record time!

6. Combining Strategies

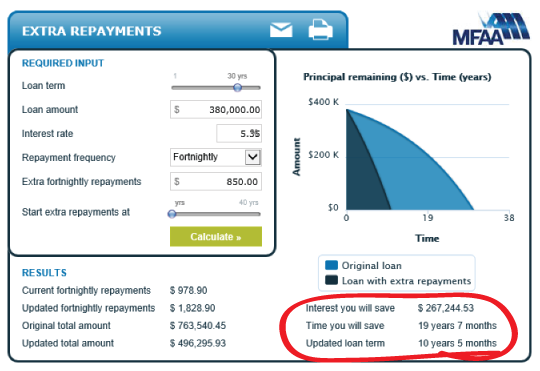

What if you could combine all of these debt strategies together?

Refinancing your home loan to a lender with a 0.65% cheaper interest rate saves $144 per month

Having the right loan set up and a budget saves $266 per month

Consolidating your credit cards into your home loan saves $900 per month

Converting your investment loan to interest only saves $390 per month

Combine all of the debt strategies and you could save a massive $1,700 per month

Now split your monthly mortgage payment and the monthly saving of $1,700 in half and make your loans payments on a fortnightly basis.

The collective result is incredible – a saving of $267,244 and 19 years and 7 months on your home loan!

Summary: Refinance but also consolidate your credit card debt into your home loan. Use an offset account or similar structure along with a budget to save into your home loan each month. Convert investment loans from principal and interest to interest only and use the total combined monthly savings from all of the strategies to make extra fortnightly payments on your non-deductible home loan.

There you have it the exact strategies you could use to pay off a $350,000 home loan in just over 10 years, while saving $267,000 in interest costs!

To recap, you always want to focus on paying off your most expensive non-deductible debt first. Not your largest debt but the non-deductible debt with the highest rate of interest. So in our example the highest interest non-deductible debt is clearly the credit card debt, followed by the home loan debt. The investment loan debt however is 100% deductible so you should always pay this debt off last.

So what’s next – do I just focus on paying off debt for the rest of my life?

In short, NO. Because unless you’re earning hundreds of thousands of dollars each year there’s just no way you’re going to be able to ‘save’ your way to wealth.

That brings us to the final piece of our 3-Step Personal Finance Business Plan …Investment.

While paying off debt helps you to build equity over time, investing [your equity] helps you to build true wealth.

…Stay tuned for our next post as we take an in-depth look at the investment phase.

Sam & Matt

Urbantech Group

>> Adelaide’s Best Home Loans +plus more…