- ENQUIRE ONLINE OR CALL US

- 08 8451 1500

The RBA’s interest rate statement for July…

Learn more about Loan Protection Plan Insurance

Important information about the protection of your home & investment loans!

Everyday life events can and will impact your ability to meet your loan repayments. How would you meet your loan repayments if you lost your job or suffered an injury, illness or even death… not really sure?

Watch the video below to find out more;

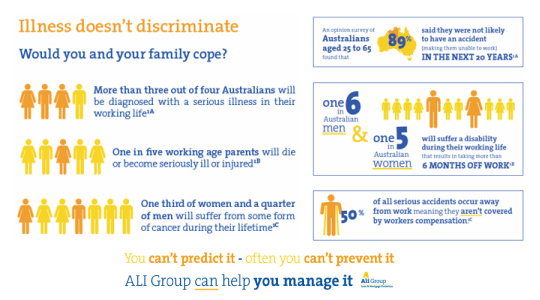

An opinion survey of Australians aged 25 to 65 found that 89% said they were not likely to have an accident [making them unable to work] in the next 20 years. However the facts of the matter are different;

- One in 6 Australian men and one in 5 Australian women will suffer a disability during their working life that results in taking more than 6 months off work.

- 50% of all serious accidents occur away from work meaning they aren’t covered by workers compensation.

You can’t predict it – often you can’t prevent it. But you can manage it!

Loan Repayment Protection is a solution…

Loan Repayment Protection is designed to provide you with financial assistance where you have suffered a serious illness or injury that is likely to prevent you from making your loan repayments for a period of time. Loan Repayment Protection also provides cover for involuntary unemployment occurring in the first year of cover.

The benefits can be used for any purpose including assisting with your loan repayments or reducing your loan balance.

A feature of our Loan Repayment Protection is that the first month of cover is absolutely free. This means that you can obtain protection now and then use this time to carefully consider your need for this cover before having to pay premiums.

Another important feature if ALI Group’s loan repayment protection is the flexibility to adjust the level of cover, making cover even more affordable.

Industry facts…

One in two industry super funds members are underinsured by $100,000 or more

- 50% are underinsured by $100,000 for life insurance

- 74% are underinsured by $100,000 for TPD

It’s estimated that life insurance cover within super is on average only 20% of what is needed. The average insurance amount payable from super is $70,000 – for those who take the default level of cover.

If you were to get sick or injured and not be able to work, Centrelink pays a maximum disability pension of $658.40 per fortnight for singles and $496.30 [each] for couples.

Where to from here…

Right now there is nothing to do, except to read this page and watch the video. Your Urbantech Finance Broker will have a chat to you about Loan Repayment Protection Insurance as part of the process of organising your loan/s. Rest assured there’s no hard sell and certainly no obligation to take up this insurance but we do want to give you the opportunity to carefully consider your options to see if it is right for you.

Are you a details person? We’ve got you covered and even some Q&A’s if you would like to learn more about Loan Repayment Protection.

P.S. If you just happened to stumble accross this page and like the idea of having protection for your loan/s then please don’t hesitate to give us a call on 08 8451 1500 to see how we may help.